The Boardroom

Young chaebol women gain upper hand over elders

[THE INVESTOR] Korea’s family-controlled conglomerates, or chaebol, often center around men, with ownership passed down from father to eldest son.

When it comes to potential heirs, far more attention is usually paid to sons than daughters, but several outstanding women, such as Lee Boo-jin of the Samsung Group and Chung Ji-yi of the Hyundai Group, have still managed to outshine their brothers.

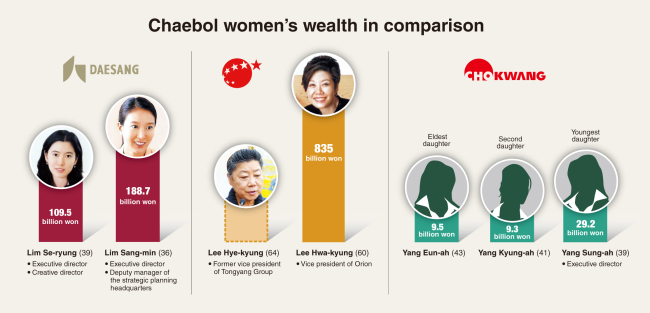

Among preeminent female chaebol scions, some shrewd ladies have even surpassed their older siblings in wealth. Here are some exceptional individuals:

|

Daesang: Lim Se-ryung and Lim Sang-min

Lim Se-ryung and Lim Sang-min are the daughters of Daesang Group Chairman Lim Chang-wook.

In Korean culture, the oldest child is usually given a bigger portion of the father’s fortunes, however, the second daughter Sang-min holds a larger number of Daesang shares due to her sister’s marriage to Samsung chairman’s son Lee Jae-yong in 1998. As this marriage made Se-ryung part of the Samsung family, giving her shares would have had unintended implications on the Lim family’s grip on the firm.

Therefore, the father gave a bigger stake to Sang-min, who was single and still in the family business. The chairman has no son.

Sang-min’s stake is currently still larger than her older sister. She owns a 36.7 percent share in Daesang Holdings, worth 187 billion won ($169 million), as of Wednesday, while Lim Se-ryung owns 20.4 percent of the firm.

However, Se-ryung’s divorce in 2009 marked a turning point in Daesang’s power game. In 2012, Se-ryung returned to the group’s flagship company Daesang Corp. as its creative director.

In contrast, Sang-min moved to the firm’s US branch after she got married. This led to a reversal of roles, with the one who had previously been an outsider moving closer to the center of the business while the other moved away from it.

In 2014, Se-ryung acquired a 0.46 percent stake in Daesang Corp., the food manufacturer.

Tongyang: Lee Hye-kyung and Lee Hwa-kyung

Tongyang Group was a Korean conglomerate with its business spanning confectionery, financial services and the cement industry. Its chairman Lee Yang-gu had two daughters, Lee Hye-kyung and Lee Hwa-kyung.

The eldest, Hye-kyung, succeeded the company and jumped into management with her husband, Hyun Jae-hyun, who became the group chairman in 1986.

In contrast, the second daughter, Hwa-kyung, started her career as an intern at Tongyang Confectionery in 1975. In 2001, she and her husband Dam Chul-gon inherited control of the group’s 16 confectionery units and formed Orion Group, separate from Tongyang. Her husband is the group chairman while Lee is the vice chairman, owning a 14.4 percent stake in Orion and 0.0029 percent in Showbox, one of the largest film production, investment and distribution companies in Korea.

Her shareholdings in listed companies are assessed to be worth 834.9 billion won ($752 million).

On the other hand, Hye-kyung’s fortunes fell drastically when the Tongyang Group collapsed in 2013 due to mismanagement and financial difficulties. The senior Lee, whose net worth was once estimated at 35 billion won, is known to have less than 5 percent of shares in listed former Tongyang companies.

Chokwang Paint: Yang Sung-A

Yang Sung-ah is the youngest of the three daughters of the late Chokwang Paint Chairman Yang Sung-min. She joined the company in 2003 and currently works as executive director in charge of the sales and technology division.

She owned a 5.6 percent equity stake before her father passed away. It was the smallest portion compared to her two elder sisters who held 5.8 percent and 5.7 percent, respectively. After the chairman died, Sung-ah inherited her father’s entire stockholdings, accounting for a 12.2 percent stake, which made her the largest shareholder.

Although she was the only one involved in the business, it was Korean taxation law that enabled her to gain the upper hand over her older sisters.

Korean law allows a reduction in inheritance tax to the company if an heir inherits the whole stock shares of a predecessor. The law was originally made to encourage family business succession, in particular with small and medium-size businesses.

However, there has been public criticism of the law, as Chokwang Paint was suspected to have abused it to avoid 50 billion won in inheritance tax.

By The Korea Herald Super Rich Team (jiwon.song@heraldcorp.com)

---------------------------------------------------

Hong Seung-wan

Cheon Ye-seon

Lee Sun-young

Yoon Hyun-jong

Min Sang-seek

Song Ji-won