Bio

[DECODED: CELLTRION] Enigma of Seo Jung-jin

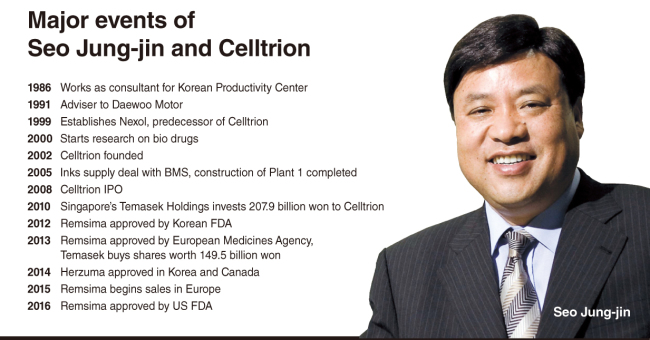

[THE INVESTOR] What frustrated Celltrion founder Seo Jung-jin 16 years ago was the lack of ambition he saw in his younger coworkers at the now-defunct Daewoo Motors. A Chinese restaurant, they said, was the way to make a living after Daewoo went bankrupt. The former Daewoo executive recalled how miserable the plan was at a speech last month. Instead of a Chinese restaurant, Seo and his six junior staff members, with only 50 million ($44,400) won start-up capital, established Nexol, the predecessor to Celltrion, now a leading biopharma company with market capitalization of more than 12.3 trillion won.

|

All that he knew about the bio industry was what he read in newspapers at the time, he reminisced.

“But I felt something is going to happen with it,” Seo told business leaders at a forum hosted by the Federation of Korean Industries.

The next thing he knew, he found himself sleeping at a $70-a-night motel to seek a chance to meet US bio industry leaders, including a CEO from Genentech Inc. and a Nobel Prize winner.

Nobody was willing to share an idea with a layman from South Korea.

But then, Seo learned from an academic conference that many antibody bio drugs would lose patent exclusivity around the year 2014. He saw the future of biosimilars -- lower cost mimics of brand-name biologic drugs that have lost patent protection -- when many people in Korea hadn’t even yet grasped the concept.

He started his own research at a container box in Songdo, near Incheon, seeking investors. Seo says he read hundreds of medical textbooks and even attended an anatomy class to better understand the mechanisms of the human body. He funded the research projects from what he earned manufacturing ingredients needed for biosimilars, with the remainder coming from the underground money market.

Many investors in South Korea ignored Celltrion, questioning its practicality. But then, Singapore-based pension fund operator Temasek invested a combined 357.4 billion won in 2010 and 2013. One Equity Partners, the private merchant banking arm of JPMorgan Chase, also invested 250 billion won in 2011.

Ending the years of disputes about Seo’s “recklessness,” Celltrion’s Remicade (infliximab) biosimilar won approval from the US Food and Drug Administration in April, marking just the second entry of a biosimilar drug in the US pharmaceutical market.

Inflectra, known as Remsima in Europe and Asia, is expected to channel in some 2 trillion won in annual profits in the US, siphoning roughly 30 percent of Remicade’s sales there.

The approval means that Korea’s biopharma technology has been recognized by the world’s most prestigious health regulator, the company said in congratulatory remarks.

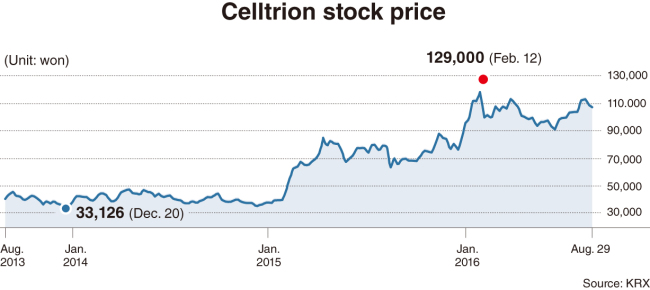

Even before the FDA approval, shares in Celltrion had nearly tripled in a year, moving from 40,000 won on Jan. 26, 2015 to a peak of 129,000 won on Feb. 12, 2016. The company is the most valuable firm on Korea’s tech-heavy KOSDAQ bourse. The chairman himself has also become the nation’s 36th richest man, according to The Investor, with assets estimated at $680 million.

Rosy prospects lie ahead for Celltrion, according to experts, referring to four more biosimilars geared for commercialization. Two of them will become the first of their kind to launch in global markets.

“I think there is a good chance that Celltrion will have a very good two or three years between 2017 and 2020 and I think there is a good chance that Celltrion will enter the US market with their Remicade biosimilar,” said Ronny Gal, an analyst at Sanford C. Bernstein & Co., in a phone interview with The Korea Herald.

But challenges remain for biosimilar-makers, he said, adding that after a quick profit, margins will decline within two to three years. Celltrion may be one of the first movers for now, but it wouldn’t always enjoy such an uncrowded field.

“Challenges for Celltrion would be that past the first wave of products, they would be competing with a lot of good companies and it’s not clear they will be first,” he said.

|

Celltrion founder Seo Jung-jin |

Rumors, rumors, rumors

Behind the thriving business, Seo and Celltrion have been under constant attack.

In 2013, Seo made a surprise announcement that he would sell the company to foreign competitors, saying he was tired of short-selling attacks from parties such as hedge funds. Short-selling refers to a speculative stock investment technique that seeks short-term gains by issuing “sell” orders with borrowed stocks.

He has claimed that some groups have been spreading false rumors to bring down Celltrion’s stock price and profits through the nefarious practice. He also blamed the nation’s financial authorities, lashing out at them and saying their attitudes are too lose to stop them.

In 2014, Seo was summoned by prosecutors for alleged stock price manipulation, which many see as the chairman being punished for criticizing the financial authorities. Later, he was fined 300 million won for violating laws on capital markets and financial investments.

The highlight was a report published in March by a group of short-sellers who called themselves “Ghost Raven Research,” who said that Celltrion was a “massive accounting fraud” and about “90 percent” of the company’s revenue had been faked.

Most of the revenue generated by Celltrion came from selling its products to its own subsidiary Celltrion Healthcare, they claimed. Less than 18 percent of the product was sold to end consumers and the company in fact had a massive inventory of unsold drugs, they added.

Celltrion at that time denied the reports, saying the short-sellers must have taken huge losses and they were circulating the false reports to recover the damage. The attack ended in a brouhaha, but dealt a severe blow to Celltrion, again raising the issue of its instability originating from market hype.

Kang Yang-ku, an analyst from HMC Investment and Securities said, quoting industry sources, that the Ghost Raven attack reflected market fears over letting Celltrion’s Remicade biosimilar enter the US market.

“In fact, there were considerable market fears and resistance inside the US for the US government endorsing the market entry of the biosimilar product developed by a foreign company,” he said.

“Rumors circulated at that time that there was an attempt to curb (Celltrion’s) market value just before the final FDA approval in April.”

Celltrion’s chaebol-like governance structure, and its subsidiaries having separate financial statements -- which makes it impossible to check on balance and cash flows between the units -- are also undeniable problems.

“Celltrion is a venture enterprise by nature, but when looking into its corporate governance structure, it looks more like a chaebol firm, such as setting up a sales company to provide contracts in a lump sum,” said Park Ju-gun, co-president of CEO Scores, a local business tracker.

Park also suggested possible internal trading between subsidies, saying the biopharma company, though classified as a big firm, is not included on the government’s watch list that bans excessive expansion. “It doesn’t have to make reports on its combined assets. So there can be some opaque internal trading.”

Celltrion is the first mover in the bio industry, faster than Samsung, South Korea’s largest conglomerate. But its stellar performance has raised curiosity on a possible merger between the two.

“The media has been establishing a rivalry (between Celltrion and Samsung). I assume that such rivalry has been established because we are doing business well,” said Lee Kun-hyeok, Celltrion’s spokesman.

“We never think that we are competing with Samsung, but we are competing with multinational pharmaceutical companies targeting the global market.”

|

It is widely known that Samsung made an offer to Seo to sell Celltrion at a below-market price 10 years ago, said Kang of HMC Investment and Securities.

“It would be difficult for Samsung to acquire Celltrion, as it has grown too big. But it is commonly known that Samsung has been pulling human resources from Celltrion to its biosimilar manufacturing arm Samsung BioLogics,” he said.

Inconsistent portfolio

What makes Celltrion most vulnerable is Seo’s inconsistency in its business portfolio, experts say.

After reaping great success in biopharmaceuticals, Seo has turned his eye to cosmetics, entertainment and even to a theme park project.

Seo by setting separate business units, has been active in investing in the entertainment sector based on his belief that cosmetics businesses can benefit from it. He has reaped huge profits from his investment in this summer’s blockbuster movie “Operation Chromite,” which has sold nearly 6.8 million tickets.

Through Dream E&M, a wholly owned subsidiary of Celltrion Holdings, in which he has a 93.9 percent stake, Seo has also been investing in TV dramas and other programs.

The CEO had been negotiating for a large theme park in Incheon until recently, but talks have stalled due to disagreement on the land price.

“He was a star when jumping into the bio industry when nobody was interested. But now I feel disappointed (by his inconsistency),” said an industry insider who declined to be named.

“Instead of pursuing a single path, Seo appears to be diversifying the business recklessly.”

Celltrion spokesperson Lee declined to comment, citing them as Seo’s personal ventures.

Performance-wise, Seo has little to be blamed for. But the uncertainty of the bio business itself could be a hurdle for Celltrion’s future, Park of CEO Score noted.

“We need to keep a close eye on Celltrion, considering the nature of the bio business,” he said, referring to the rapid rise and the fall of Theranos CEO Elizabeth Holmes, who just within the last year has seen her estimated net worth drop from $4.7 billion to zero over the company‘s questionable blood-testing technology.

“For now, Celltrion seems to be benefiting from overflowing capital that has no particular destination. That is why we have to remain careful about Celltrion’s future path.”

By Cho Chung-un/The Korea Herald (christory@heraldcorp.com)

Staff reporter Park Ga-young contributed to this article. -- Ed.