Mobile & Internet

[DECODED: KAKAO] KakaoTalk’s domestic glory falls short overseas

[THE INVESTOR] KakaoTalk is synonymous with mobile messenger in South Korea, one of the most-wired countries in the world.

It dominates the mobile messaging market here, with more than 95 percent of some 43 million smartphone users chatting via the bright yellow app daily.

People use it to chat with their friends, family and even colleagues at work. They send pictures and videos as well as make calls and video chat for free.

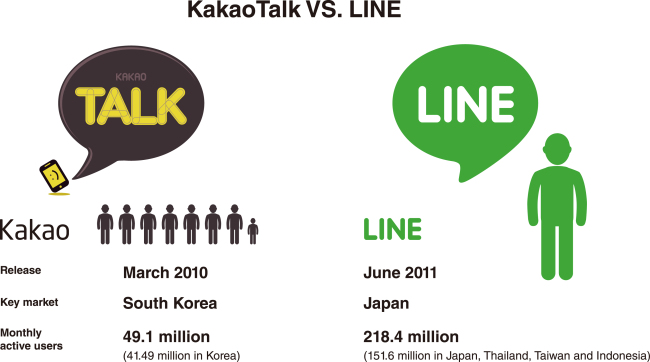

Launched in March 2010, KakaoTalk grew at a rapid pace on the back of fast-growing smartphone penetration here -- or perhaps it accelerated the process.

|

Its operator Kakao has since expanded the mobile platform, providing a plethora of services from games and webtoons to payment, social media and even taxi hailing. The company is continuously eyeing new markets through active mergers and acquisitions such as -- most notably -- with Daum, the No. 2 search engine here, and Loen Entertainment, a music streaming service.

Armed with the ubiquitous mobile messenger, Kakao’s dominance in Korea is expected to continue. However, its lack of presence in overseas markets has led to concerns about the company’s growth going forward, especially when compared to its domestic rival Line -- a subsidiary of internet giant Naver -- that is thriving with a strong foothold in Japan and Southeast Asian countries.

Kakao’s Korea success

KakaoTalk has 49.1 million active users globally, including a whopping 41.49 million in South Korea -- more than Facebook’s 16 million monthly active users here.

As the first instant, free, internet-based messenger, KakaoTalk secured users early on and seized first-mover advantage.

“A messenger is a service where friends have to be in the same space,” a spokesperson for Kakao said. “Due to this characteristic, when a single messenger has already settled in a country, it is difficult for another to catch up in the market. While there were other messengers when KakaoTalk was released, many people started using our service from the beginning, which strengthened our presence in Korea.”

The immense domestic success has vaulted the startup to a tech giant, a rare feat in a country where family-owned conglomerates dominate all kinds of businesses.

However, when it comes to overseas markets, KakaoTalk has a long way to go.

Kakao’s founder and Chairman Kim Beom-su has set global expansion as the firm’s goal since 2011. “Without global competitiveness, (we will) die,” he told the press in 2011, adding Facebook and Twitter will become Kakao’s rivals in the future.

Since then the company has made several attempts to enter international markets, including Japan and Indonesia. The results, however, have been disappointing, with a falling number of overseas users in the past few years.

Related articles:

Kakao founder Kim Beom-su’s voyage through the IT world

Chairman tightens grip on business empire

“I think it’s already late for KakaoTalk (to enter overseas markets),” Rim Ji-hoon, CEO of Kakao, said in an interview with the Korea Economic Daily in April. “For messengers, the winner of each country is clear. Kakao, by prioritizing domestic business, didn’t have enough ability to utilize resources overseas. But when competing not with messenger, but with content such as games and music, there is still a chance.”

The company’s latest Loen Entertainment acquisition is viewed as a move by the tech giant to tap into global markets. In March, Kakao acquired a 76.4 percent stake in Loen Entertainment, the operator of Korea’s top music streaming and downloading service MelOn, for 1.87 trillion won ($1.69 billion).

“By combining Kakao’s various mobile platforms and Loen’s music content, we expect to see huge synergy to establish a base for our global expansion,” Lim announced after the acquisition.

Line eyes Japan, Taiwan, Thailand and Indonesia

Line messenger took a different approach after suffering defeat at home to its smaller rival Kakao and overseas -- to WhatsApp in the US and WeChat in China.

Line was launched in Japan in March 2011, a year later than Kakao, by Korea’s tech giant Naver. After its debut, the app quickly gained momentum in Japan, thanks to its cute character stickers that attracted millions of users to buy and send them to each other. It became Japan’s largest social network in 2013 and is also the No. 1 messenger in Taiwan and Thailand.

The mobile messenger reported 218.4 million monthly active users globally, with 151.6 million, or 70 percent, coming from its four major markets, Japan, Thailand Taiwan and Indonesia.

The remaining users hail from other South Asian countries, some in the Middle East and also in Korea. The company declined to share exact details about the number of users here, but it is expected to exceed 10 million.

|

The Kakao Friends flagship store in Gangnam, southern Seoul. Kakao |

In July, Line made a historic market debut in Tokyo and New York, in the largest tech initial public offering of the year, boosting the value of the company to $8.7 billion.

Line attributes its global success to something called “culturalization,” a process where it develops services and products catered to the unique needs of each market, which is similar to localization.

“Line’s strength is to give full authority to local units for them to provide services that are tailored to their respective culture and user behavior,” Shin Jung-ho, the chief globalization officer of Line, told the press in Thailand in May. “In order to compete against large global companies, we need to think from the perspective of local customers.”

Kakao’s Ryan Lion vs. Line’s Brown bear

Meanwhile, the rivalry between the two giants continues offline.

Kakao and Line have brought their cute characters that were previously only available on smartphone screens to the real world through character stores. And these are gaining immense popularity and generating cash for the companies.

Line took the lead in this area, opening its first merchandise shop Line Friends Store in 2013 as a pop-up store in touristy Myeong-dong, central Seoul. Riding the tide of popularity, it now operates 22 official shops across Asia, including 12 in Korea, with the rest in Japan, China and Taiwan. It also has an online store.

At these outlets, customers can purchase clothes, toys, cosmetics, food, household and every kind of paraphernalia that one can imagine. These feature the Line app’s characters such as Brown, the bear, and Cony, the white rabbit -- all known as Line Friends.

The floors are filled with tourists, especially those from Japan and Southeast Asian countries.

|

Customers look around the Line Friends store in Myeong-dong, central Seoul. Lee Sang-sub/The Investor |

Kakao followed Line, opening its first store in Sinchon, the popular college district in Seoul, in October 2014. Now there are 18 Kakao Friends stores across South Korea and an online store, but none overseas.

In July, Kakao opened its first three-story flagship store in Seoul’s Gangnam district. Inside the flagship store, there are more than 1,500 merchandise featuring popular Kakao Friends characters, including Ryan, the newcomer lion character.

Reflecting Kakao’s market dominance here, most customers are Korean, with more than 450,000 people visiting the Gangnam store in its first month of opening, the company said.

Line and Kakao are both expanding their character business rapidly to ride the boom. According to the state-run Korea Creative Content Agency, Asia’s character market exceeds more than $20 billion and is expected to grow at 6.5 percent every year until 2017.

“For both Line and Kakao to succeed, they need to grow together,” an industry insider said. “Because in the long run, Line and Kakao have to compete with global players.”

By Ahn Sung-mi (sahn@heraldcorp.com)

![[Exclusive] Korean military set to ban iPhones over 'security' concerns](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=151&simg=/content/image/2024/04/23/20240423050599_0.jpg)

![[Herald Interview] Bridging Korea, Philippines for better future](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=151&simg=/content/image/2024/04/23/20240423050735_0.jpg)