Samsung

Elliott says Samsung taking 'constructive step'

[THE INVESTOR] Elliott Management, a US activist hedge fund, said on Nov. 30 that it views the restructuring plan announced by Samsung Electronics as the tech giant taking “a constructrive initial step,” but urged it to make more changes.

“We view the plan outlined by Samsung to be a constructive initial step,” Blake Capital and Potter Capital, two affiliates of Elliott Management, said in an emailed statement.

“We anticipate more meaningful changes following the company’s corporate structure review. We look forward to working with Samsung.”

|

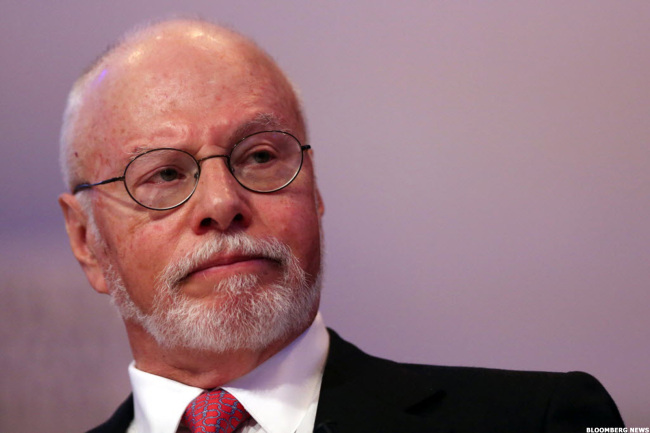

Elliott Management CEO Paul Singer |

The US hedge fund was responding to Samsung Electronics’ announcement on Nov. 29 that it would initiate a review of the creation of a holding company. The South Korean tech giant also said it would increase cash returns to shareholders and have at least one outside director as part of efforts to enhance shareholder value.

The announcement came nearly two months after Elliott sent an open letter to Samsung urging it to make structural changes.

On Oct. 6, Elliott Management proposed the South Korean electronics giant reshape its corporate structure, saying it would not only increase the shareholder value but would also open a door for the new leadership.

It suggested the tech giant split into holding and operating companies, and list the operating unit on the Nasdaq stock exchange.

Elliott, through its affiliates -- Blake Capital and Potter Capital – hold a 0.62 percent stake in Samsung Electronics. It strongly opposed a merger between Samsung C&T and Cheil Industries last year.

By Cho Chung-un/The Korea Herald (christory@heraldcorp.com)

![[From the Scene] KG Mobility poised to take next leap](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=151&simg=/content/image/2024/04/24/20240424050621_0.jpg)