Economy

US-China feud poised to hurt Korea’s exports

[THE INVESTOR] Concerns are rising here that South Korea may become one of the biggest victims of escalating trade conflicts between the US and China in the presidency of Donald Trump, who is set to take office Jan. 20.

Earlier this month, the two superpowers filed complaints against each other to the World Trade Organization in the latest of a series of mutual bashings.

If Trump takes tough measures against China, including the imposition of huge tariffs, as he promised on the campaign trail, it will have a significant impact on South Korea’s exports to China, experts say.

|

In its recent report, Oxford Economics, a global advisory firm, warned South Korea and Taiwan would be hurt most by fallout from US sanctions on China’s export items assembled with imported intermediary goods.

According to the Korea Chamber of Commerce and Industry, intermediary goods account for more than 70 percent of South Korea’s shipments to China, its largest trading partner. Analysts estimate that a 10 percent decline in China’s exports to the US would cause a 0.36 percent decrease in South Korea’s overall exports.

South Korea saw its shipments to China rise by 0.4 percent from a year earlier to $11.7 billion last month, marking the first on-year increase since June 2015.

It is far from assured, however, that this unexpected rebound will lead to an upward trend, given the intensifying feud between the US and China is coupled with Beijing’s moves to make Seoul pay the economic price for agreeing to deploy an advanced US missile defense battery here.

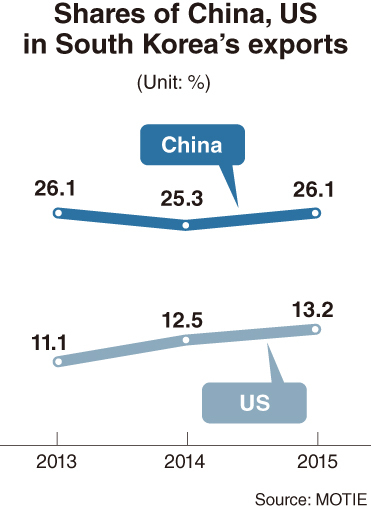

South Korea’s exports to the US are also set to be hit by protectionist measures pledged by Trump, including a possible renegotiation of a bilateral free trade agreement that he has called a “job-killing deal.” The US is the second-largest market for South Korean exporters, following China.

Stronger headwinds from the world’s two largest economies are poised to dampen a recent rebound in South Korea’s outbound shipments. The country’s exports climbed by 11.6 percent from a year earlier in the first 20 days of this month, following a 2.7 percent increase in November, according to data from the Ministry of Trade, Industry and Energy.

Trade policymakers here have pledged to play a role in checking against the rising global protectionism in the framework of bilateral trade pacts and on multilateral stages such as the WTO and the summit of the Group of 20 major economies.

“We will continue to try to make it understood by our trading partners that free trade agreements are mutually beneficial and should be implemented faithfully,” Trade Minister Joo Hyung-hwan said in a recent meeting with reporters.

South Korea has bilateral trade pacts with both the US and China, which came into force in 2012 and 2015, respectively.

Chung In-gyo, an economics professor at Inha University, indicated Seoul needs to seek to enhance the liberalization level of its existing trade deals and include measures to abolish nontariff barriers in renegotiated pacts.

Economists here say the country should also be in step with efforts by the US and China to improve domestic business environment.

In a recent meeting of the State Council, Chinese Premier Li Keqiang vowed to strengthen the policy to reduce the tax burden on companies next year. Beijing has pushed ahead with tax cuts, which are estimated to amount to 500 billion yuan ($76.8 billion) this year, with a particular focus on helping the Chinese economy shift toward consumption and services from manufacturing.

China’s policymakers appear to have in mind Trump’s campaign proposal to slash the US corporate income tax rate from 35 percent to 15 percent. Some US experts see the proposed cut as too much, and have suggested that a reduction to slightly above 20 percent would be revenue-neutral and practicable.

Either way, the reduction would be significant enough to attract Chinese companies, which face corporate tax rates ranging from 15 percent to 25 percent at home.

The move would also encourage US corporations to bring home their overseas plants and trillions of dollars of profits earned abroad and housed in kinder tax jurisdictions.

South Korea’s opposition parties, which combined hold a majority in the 300-member legislature, stopped short of pushing through their bills aimed at raising the maximum corporation tax rate set at 22 percent in the parliamentary session that ended early this month.

But they are poised to push for a tax increase again in the run-up to the next presidential election that is likely to be held in the early part of next year, depending on the result of the Constitutional Court’s ongoing review of lawmakers’ impeachment of President Park Geun-hye.

Rep. Moon Jae-in, a front-runner among opposition presidential hopefuls, has made clear his plan to increase the maximum corporation tax rate to 25 percent.

Many economists here say a corporate tax increase is least needed for the country’s economy, which is forecast by research institutes and economic organizations at home and abroad to grow by an average 2.3 percent in 2017, with more pessimistic outlooks expecting the growth rate to tumble below 2 percent.

A report released earlier this year by the Korea Development Institute, a state-run think tank, said an average 1 percentage point reduction in corporation taxes would result in a 0.2 percentage point increase in corporate investments.

By Kim Kyung-ho/The Korea Herald (khkim@heraldcorp.com)