Industrials

Toshiba’s NAND stake a good bet for SK hynix: analyst

[THE INVESTOR] Securing a stake in Toshiba’s memory chip business will be a good bet for rivals, especially SK hynix that is beefing up NAND production to meet the soaring demand for long-term storage in cloud and Internet of Things services, industry watchers said on Jan. 20.

According to news reports, Toshiba is considering selling off an additional stake in its NAND business unit to Western Digital, a joint venture partner in its production plant in Japan, and possibly other investors to help off-set losses in its nuclear power business.

|

Toshiba, the world’s second-largest NAND manufacturer with a 20 percent market share, is also considering splitting off the NAND business before the capital increase. Samsung Electronics is the market leader in NAND chips with a 35 percent share.

“The combined share of Toshiba and Western Digital will exceed that of Samsung in the NAND market, while the resulting unit will strengthen competitiveness through the new funding,” said Doh Hyun-woo, an analyst at Mirae Asset Daewoo Securities.

“Other chipmakers could eye a stake in the unit. Especially, SK hynix could seek synergies as it is ramping up NAND production more recently.”

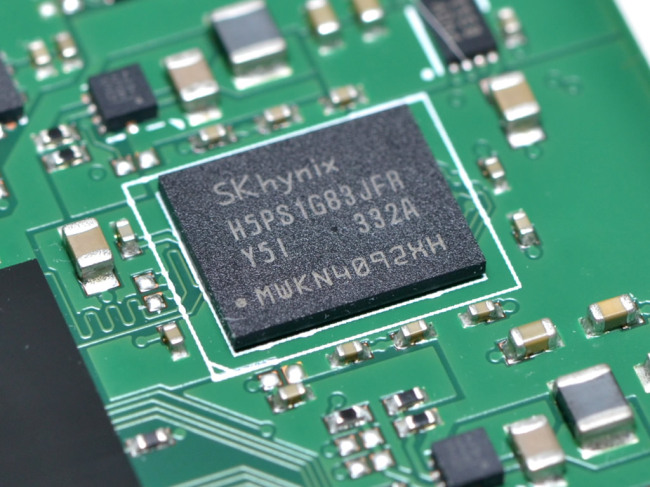

SK hynix, the nation’s No. 2 chipmaker, still depends almost 70 percent of its profits on DRAM chips that are used for temporary data storage in smartphones and PCs. But the company is recently pouring resources into NAND production.

In December, SK hynix announced a 3.15 trillion won (US$2.63 million) investment plan in its memory chip business, including a new 2.2 trillion won NAND production plant to be completed by 2019 in Cheongju, South Chungcheong Province.

The analyst predicted Toshiba would reduce technological gap with Samsung, the market leader, as it improves its financial structure and spends more on research and development.

By Lee Ji-yoon (jylee@heraldcorp.com)

![[From the Scene] KG Mobility poised to take next leap](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=151&simg=/content/image/2024/04/24/20240424050621_0.jpg)