The Boardroom

Samsung’s Lee Kun-hee earns highest dividends in 2016

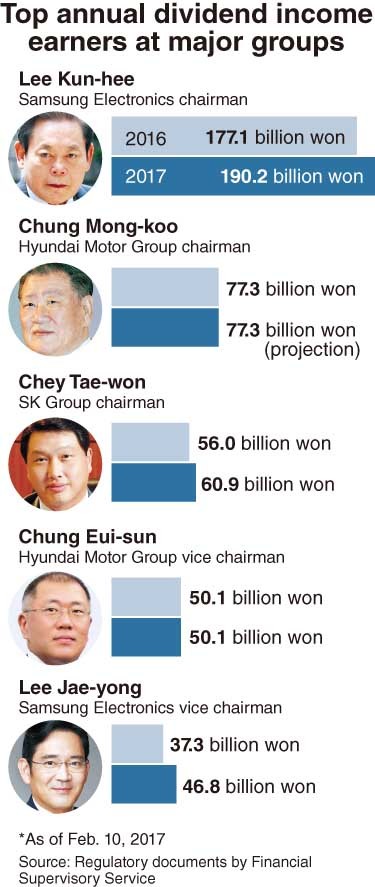

[THE INVESTOR] Samsung Group Chairman Lee Kun-hee topped dividend earnings in the nation in 2016 for the eighth consecutive year, earning 2 1/2 times more than that of fellow business tycoon Chung Mong-koo, chairman of Hyundai Motor Group, data showed on Feb. 10.

Lee, hospitalized since May 2014 after suffering a heart attack, received 190.2 billion won ($165.4 million) in dividends last year, a 7.4 percent gain from the 177.1 billion won earnings from a year earlier, according to data by the Financial Supervisory Service.

|

A majority of his dividend income came from 137.4 billion won in dividends from Samsung Electronics, the group’s tech giant in which Lee has a 3.38 percent stake. Another 49.8 billion won of dividends were from Samsung Life Insurance, with 3 billion won from Samsung C&T as well.

Following Lee, Chung Mong-koo, chairman of Hyundai Motor Group, earned 53.6 billion won in dividends from Hyundai Motor, Hyundai Steel and Hyundai Glovis. Assuming he will earn 23.7 billion won in dividends from Hyundai Mobis where Chung has 7 percent stake and the company will pay dividends at the 2015 level of 3,500 won per share again this year, Chung’s total earnings in dividends last year are expected to be around 77.3 billion won.

Trailing Chung is SK Group Chairman Chey Tae-won with 60.9 billion won from his 23.4 percent stake in SK Holdings. His dividend income last year rose 8.8 percent from a year earlier. SK Holdings has been increasing its dividend payments since 2014.

The fourth spot went to Chung Eui-sun, vice chairman of Hyundai Motor and Chung Mong-koo’s son, with 50.1 billion won.

Lee Jae-yong, son of Lee Kun-hee and vice chairman of Samsung Electronics, will earn 46.8 billion won in dividends from Samsung affiliates, including Samsung Electronics, Samsung C&T, Samsung SDS and Samsung Fire & Marine Insurance.

Meanwhile, there have been mounting calls for South Korean listed firms to raise their dividend yields to improve shareholder value.

South Korea’s average dividend yield rate, or the ratio of dividends per share to the current share price, is expected to mark 1.88 percent, according to a recent report by Daeshin Securities, lagging far behind that of those listed on emerging markets.

The figure is 4.9 percent in Taiwan, 3.53 percent in Turkey and 3.36 percent in Brazil.

By Kim Yoon-mi/The Korea Herald (yoonmi@heraldcorp.com)