Industrials

SK hynix willing to acquire more stakes in Toshiba: CEO

[THE INVESTOR] SK hynix CEO and Vice Chairman Park Sung-wook on Feb. 23 hinted at the chipmaker’s intention to acquire more stakes in Toshiba’s chip business adding to its earlier bid for a 20 percent stake.

“We have not yet received any deal conditions or schedules (from Toshiba),” he told reporters in Seoul. “If there is an offer, we will consider it.”

|

On Feb. 7, SK hynix announced its bid to acquire a 20 percent stake in Toshiba’s lucrative NAND chip business that is enjoying a boom on soaring demands for cloud, big data and Internet of Things services. Its bidding price is estimated about 3 trillion won (US$2.62 billion).

More recently, however, the cash-strapped Toshiba said it could sell up to 50 percent of the stakes in the company and its management control.

SK hynix, Taiwan’s Foxconn, Micron Technology and Bain Capital are said to have participated in the first bidding. Now the competition is heating up, with more big-name bidders, including Apple, Microsoft and Taiwan’s TSMC, being cited.

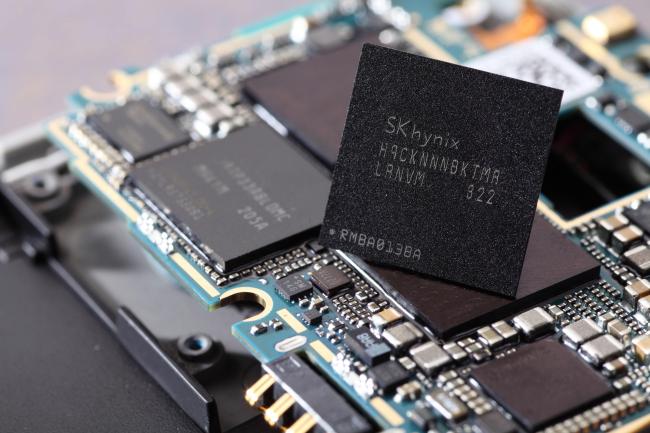

SK hynix currently depends almost 70 percent of sales on DRAM chips that are used for short-term data storage in smartphones and PCs. Securing an access to Toshiba’s advanced NAND technology is expected to become a boon for it to become a potent player in the still nascent 3-D NAND era.

Toshiba is the world’s second-largest NAND manufacturer next to Samsung Electronics.

Since the Toshiba’s announcement, SK hynix has been gauging benefits of acquiring more stakes in the company. Industry watchers have also pointed out a 20 percent stake would allow only limited benefits for SK hynix.

Considering the planned premium on management control, sources predict the bidding price could surge, almost tripling the price offered by SK hynix.

By Lee Ji-yoon (jylee@heraldcorp.com)