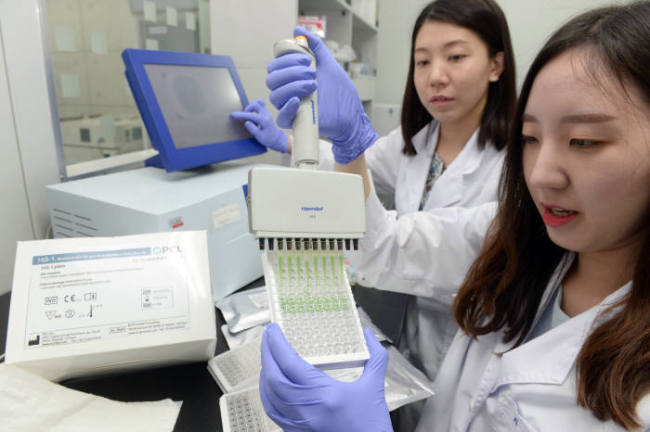

Bio

PCL closes up 17 percent on first day of trading

[THE INVESTOR] Shares of South Korea’s in vitro diagnostics company PCL surged over 17 percent on its KOSDAQ debut on Feb. 23, easing concerns after a failed attempt to go public last year.

PCL’s shares ended at 9,160 won (US$8.05), up 17.44 percent of the opening trading price of 7,800 won. Its initial public offering price was 8,000 won.

|

Related:

[INTERVIEW] PCL CEO pledges turnaround in 2017 with multiple deals

PCL in talks with Novartis to develop companion diagnostics

This is the second attempt for the company, which develops blood testing kits that can detect multiple diseases such as HIV and hepatitis C simultaneously, after one failed initial public offering plan due to lukewarm investors’ response for the loss-making firm.

Established in 2008, PCL has been posting losses because of hefty spending on research and development for its proprietary technology in immobilizing disease biomarkers, which is key in vitro diagnostics.

But years of struggling seems to have paid off as it reached a deal worth 10 billion won to supply multiplex testing kits to China’s Zhuhai Livzon Diagnostic in February.

In an interview, PCL chief executive Kim So-youn said the firm struck four more deals since its blood testing kit, called Hi3-1, obtained Europe’s CE marking in August last year. It also inked an agreement with Belgium-based Volition RX Limited to develop a cancer diagnostic kit this year.

The strong start also stemmed from setting its IPO price at a low level of an indicative price range of 10,500 won to 13,000 won, according to market watchers.

The PCL CEO pledged a turnaround this year to post revenue of 9.8 billion won and operating profit of 2.5 billion won.

By Park Han-na (hnpark@heraldcorp.com)