Industrials

SK renews confidence in Toshiba deal

[THE INVESTOR] SK Telecom CEO Park Jung-ho who is currently leading SK Group's ongoing talks to buy Toshiba’s memory chip business unit showed confidence in the upcoming bidding during his visit to the US last week.

“SK hynix is falling behind rivals? I don’t think so,” he told reporters in San Jose, California, on May 11. “There might be a surprising news soon.”

Park has played a key role in SK Group’s big purchases in recent years, including then Hynix Semiconductor in 2011. He was visiting the US last week to attract investors following his recent trip to Japan.

|

Related:

SK chief visits Japan for Toshiba deal

SK hynix teams up with Bain Capital for Toshiba deal

SK hynix to continue 3-D NAND investments despite Toshiba bid

“I visited Japan before coming to the US. I felt a growing consensus among employees and shareholders at Toshiba that a memory chip maker should become the new owner of the business,” he added.

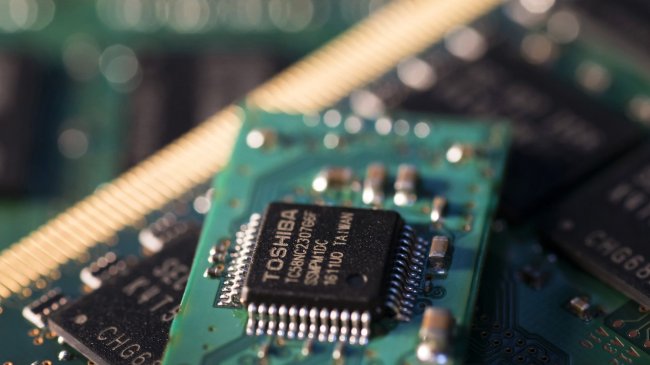

SK hynix, the nation’s No. 2 memory chipmaker, is one of the five potent bidders for the 2 trillion yen (US$18.1 billion) deal, along with Taiwan’s Foxconn, US chipmakers Western Digital and Broadcom and US private equity firm KKR.

Of them, only SK hynix and Western Digital produce memory chips.

Park declined to further elaborate on any progress made in his recent trips to Japan and the US, citing the sensitivity of the issue amid the intensifying bidding war.

Despite its strong presence in DRAM chips, SK hynix has yet to secure a firm footing in NAND chips whose demand is soaring for long-term data storage for Internet of Things, big data and cloud services.

By attaining Toshiba’s NAND business, the Korean chipmaker aims to gain access to the Japanese rival’s advanced manufacturing technology and eventually become the No. 2 player in the NAND market.

Equipped with an abundant cash flow, the nation’s third-largest conglomerate has been making all-out efforts to attract Japanese allies, including Development Bank of Japan, in order to soothe the local government’s concerns over tech leaks to Chinese or Korean chip rivals.

Bain Capital, a US private equity firm with a strong investment portfolio in Japan, has recently joined the SK-led consortium as the first financial investor.

Goldman Sachs that is working with Toshiba for the sale plans to hold the main binding bid as early as later this month and name the preferred bidder in June. Morgan Stanley is the financial advisor for SK hynix.

By Lee Ji-yoon (jylee@heraldcorp.com)

![[KH Explains] Korean shipbuilding stocks rally: Real growth or bubble?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=151&simg=/content/image/2024/04/25/20240425050656_0.jpg)

![[Hello India] Hyundai Motor vows to boost 'clean mobility' in India](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=151&simg=/content/image/2024/04/25/20240425050672_0.jpg)