Economy

Korean economy’s recovery momentum weakening

[THE INVESTOR] A recent string of economic indicators point to the weakening recovery of the Korean economy, casting doubts over the government’s expectation that this year’s growth rate will reach 3 percent.

In its monthly economic assessment report released last week, the Ministry of Strategy and Finance said the recovery pace “was not solid,” as an upturn in exports and facility investment was offset by weak industrial output.

|

The cautious assessment followed analysis made earlier by the Korea Development Institute, a state-run think tank, that the recovery momentum of Asia’s fourth-largest economy, which began picking up in the fourth quarter of last year, has recently shown signs of weakening.

It also came two weeks after the government revised up its growth forecast for this year to 3 percent from the initial target of 2.8 percent, expecting stimulus effects from an 11 trillion won ($9.6 billion) supplementary budget.

“Given the current recovery trend, the Korean economy is seen to expand 2.8 percent at best this year,” said Ju Won, an analyst at the Hyundai Research Institute, a private think tank.

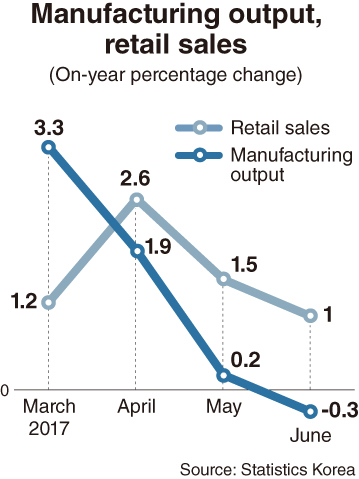

According to data from Statistics Korea, industrial output increased 1.5 percent in June from a year earlier, down from 2.6 percent in the previous month.

Production in the mining and manufacturing sector decreased 0.3 percent on-year in June, marking the first negative growth in eight months.

Factories across the country ran at an average 71.6 percent of full capacity in the second quarter, the lowest since the January-March period of 2009, when the factory operation rate remained at 66.5 percent as Korea struggled with the fallout from a global financial crisis.

On-year increase in construction investment decelerated from 15.1 percent in May to 6.5 percent in June. Construction investment, which contributed 1.6 percentage points to the 2.8 percent growth last year, is expected to be further dampened by measures taken earlier this month to curb rising home prices.

Private consumption, which accounts for about half of the country’s gross domestic product, is expected to remain sluggish in the coming months. Retail sales, a key measure of consumer spending, rose 1 percent in June from a year earlier, down from 1.5 percent in May and 2.6 percent in April.

Mounting household debt, which amounted to 1,360 trillion won as of end-March, will likely be coupled with consumer price hikes and a fall in the value of financial and property assets to further dampen private consumption.

Exports and facility investment have remained bright spots for the economy, but experts warn of a downturn during the rest of the year.

Korea’s overseas shipments rose 19.5 percent in July from a year earlier, extending the gaining streak to nine months.

Barring the export of semiconductors and ships, which jumped 57.8 percent and 208.6 percent, respectively, the increase rate stood at a mere 2.8 percent, according to analysis by the KDI.

Particularly worrisome is the sluggish performance of automakers, which have accounted for more than 10 percent of the country’s total exports.

Troubled with strikes and decreasing demand, car manufacturers have warned that they may have to move factories abroad if an upcoming court ruling upholds a labor call for widening the scope of ordinary wages, resulting in increasing wage costs by trillions of won.

Facility investment rose 5.3 percent on-month and 18.7 percent on-year in June on the back of increased demand for semiconductor equipment and machinery. But facility investment is expected to take a downturn down the road, analysts say.

A set of external downside risks, including rising tensions over North Korea’s nuclear weapons and missile programs and trade protectionism, are also poised to weigh on the economy.

Experts note there is limit to bolstering growth mainly by expanding fiscal spending as planned by President Moon Jae-in’s administration, saying forging conditions favorable for corporate investments are needed to spur the economic recovery.

“Policies churned out by the new government so far will only increase costs to be shouldered by companies,” said Sung Tae-yoon, a professor of economics at Yonsei University.

The Moon administration is moving to raise corporate taxes, turn temporary jobs into permanent ones and increase minimum wages.

These measures have already prompted backlash from businesses.

Trade, Industry and Energy Minister Paik Un-gyu met owners of local textile companies Friday to ask them to reconsider moving production abroad in response to minimum wage increases.

Experts call on the government to work out measures to reinvigorate corporate activity and promote industrial innovations rather than being tilted toward pushing ahead with income-led growth by expanding fiscal expenditures.

In a report released last week, the BOK noted the vitality of the Korean economy plummeted to half the average level of member states of the Organization for Economic Cooperation and Development during the period between 2010 and 2017, compared to the pre-global financial crisis era.

“Growth could be spurred persistently only by improving economic fundamentals,” said Sung.

Kim kyung-soo, a professor of economics at Sungkyunkwan University, noted increased fiscal deficits would make the economic structure more unstable.

By Kim Kyung-ho/The Korea Herald (khkim@heraldcorp.com)