Economy

[MOON’S 1ST YEAR] Chaebol: winners and losers

[THE INVESTOR] The nation’s family-run conglomerates were on a roller coaster ride in the first year of the liberal Moon Jae-in government. Some of them struggled to cope with toughened regulatory surveillance, while others were reeling from their own internal risks.

|

One thing to note is that contrary to the concerns, Moon’s chaebol reform policy had a limited impact in deterring investor sentiment. The benchmark bourse KOSPI soared more than 7 percent, while the secondary KOSDAQ jumped a whopping 33 percent -- the highest increase among the past five administrations.

|

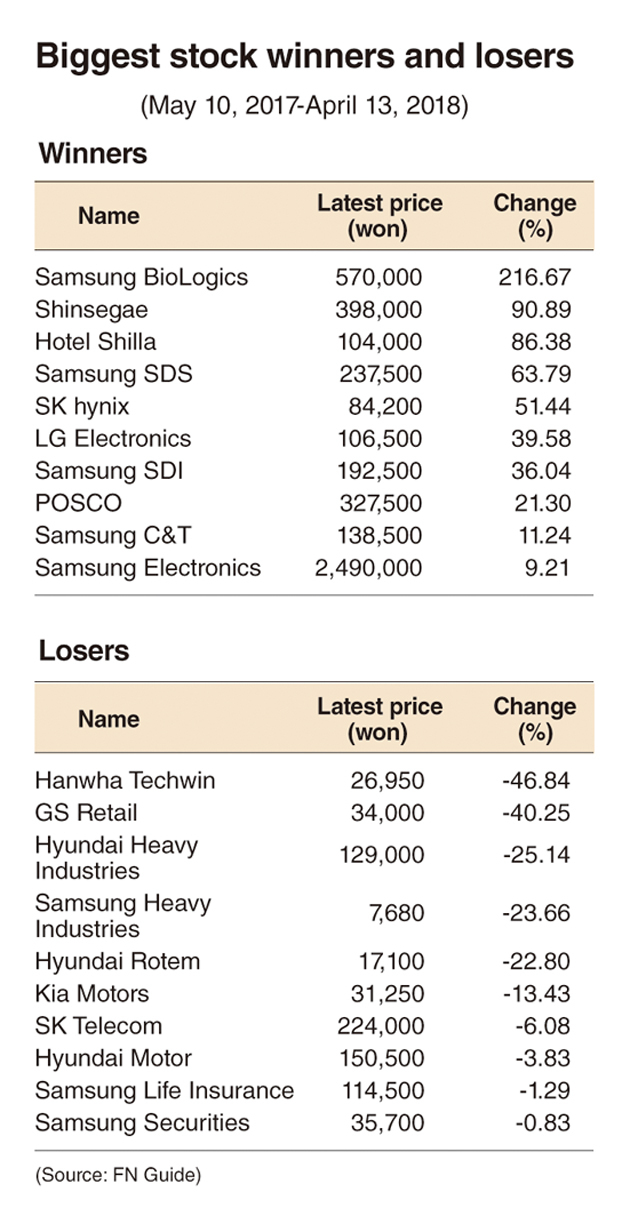

Here are some of the prominent winners and losers under the new government in terms of stock value, reputation, owner risk and business growth.

SAMSUNG ELECTRONICS [LOSER]

-- Reputation was tarnished by Vice Chairman Lee Jae-yong’s corruption trials but had limited impact on business; stock price rose 9 percent over the past year on record-breaking earnings

-- Regulatory surveillance expected to get tougher ahead of pending leadership succession

-- Elliott upping pressure as it seeks compensation on losses from 2015 merger between Samsung C&T and Cheil Industries

-- China’s chip production to take a toll on sales

-- BUT, anticipation is building toward the next Galaxy S ahead of the series’ 10th anniversary next year and the pending first foldable phone

OTHER SAMSUNG UNITS [LOSER]

-- Shares of Samsung BioLogics, the biggest gainer in KOSPI over the past year, tumbled on accounting fraud allegations, and a bumpy road lies ahead due to the anticipated stake sale of its partner Biogen later this year

-- Samsung Securities still reeling from dividend payout error, regulators mulling fines for breaching trading rules

-- Shares of other key units closely linked to succession, including Samsung C&T and Samsung SDS, experiencing stock price declines regardless of business performance

KOREAN AIR [LOSER]

-- Owner risk snowballing as Hanjin Group’s founding family faces investigations on multiple charges of assault, business obstruction and tax evasion

-- Company morale has hit rock-bottom, as employees are calling on Chairman Cho Yang-ho to step down

-- First-quarter earnings to fall on hike in fuel prices, losses in hotel business in Los Angeles, incentive payouts

-- BUT, JV with Delta Airline triggering expectations for cost-cutting and more flights

HYUNDAI MOTOR GROUP [LOSER]

-- Shares of Hyundai Motor, Kia Motors and Hyundai Mobis suffered losses over the past year largely due to sluggish car sales in key markets

-- Governance reform plans earned government backing despite the owner family facing huge capital gains tax of more than 1 trillion won

-- Elliott staging proxy battle but limited impact due to tiny stake

-- BUT, China sales almost doubled in April

LG ELECTRONICS [WINNER]

-- Stock price jumped almost 40 percent over the past year largely buoyed by upbeat TV and appliance sales

-- Still, no sign of recovery in sluggish phone sales

-- Beefing up automotive parts business; acquired Austrian light maker ZKW Group for 1.4 trillion won – the largest-ever purchase by LG

-- Free from so-called owner risk, as the group has already divided business units among family members

SK GROUP [WINNER]

-- M&A talks speeding up; Big deals include SK Siltron (620 billion won), Toshiba (4 trillion won), ADT Caps (2.7 trillion won)

-- Key businesses such as semiconductor, biotech and telecom in line with the government’s industrial push

-- Shares of SK hynix soared more than 50 percent

-- Rosy business outlook after acquisition of Toshiba’s chip business unit

-- Beefing up investments in connected car businesses like EV batteries, IoT and car-sharing; Pharmaceutical units developing new drugs

By Lee Ji-yoon (jylee@heraldcorp.com)