Economy

[MOON’S 1ST YEAR] Skepticism shrouding Moon’s real estate policies

[THE INVESTOR] Over the past year since its inauguration in May last year, the Moon Jae-in administration has been churning out more than a dozen regulations to cool the overheated real estate market.

The regulations include tougher standards on mortgage loans and reconstruction of aging apartments and higher transfer taxes. The administration has also designated regions across the nation as “speculative districts,” which are under stricter rules and monitoring schemes to prevent speculative investments and keep housing prices in check.

|

Related:

President gets 2 out of 5 stars on economic policies

Chaebol: winners and losers

The government is considering to increase the property tax rate as the last resort, but market experts forecast such measure could fall far short of achieving its goal to tame the market.

“The anticipated move to increase the property tax will be able to keep speculators at bay, but I doubt if it will be effective in stabilizing the overall housing market,” Shim Gyo-eon, a professor at Konkuk University’s department of real estate studies, adding the government needs to come up with long-term measures based on public discussions to decide real estate policies, which play an integral role in the domestic economy.

“The current regulations and those that are in the pipeline are mostly punitive approaches targeting homeowners in certain areas, like Gangnam, not measures that can fundamentally address problems,” he said.

Despite the efforts, the average price of an apartment -- the most popular housing type in Korea -- surged 8.52 percent in the capital Seoul alone so far this year, and 4.26 percent in the capital region including Seoul and its surrounding cities, according to Korea Appraisal Board, a company that collects data of property values.

Some are concerned that the current real estate polices are almost the same as those adopted during the Roh Moo-hyun government, from 2003 to 2008, and therefore may have the same result; skyrocketing prices.

The Roh government rolled out similarly stringent real estate laws, imposing higher property taxes, up to 3 percent, and adopting a house price assessment scheme aimed at calculating the prices of houses in a realistic manner, 80 percent of the actual market price from the previous 60 percent. The average apartment price, however, reached record highs under the administration.

Overseas examples show that a higher property tax cannot be a silver bullet.

|

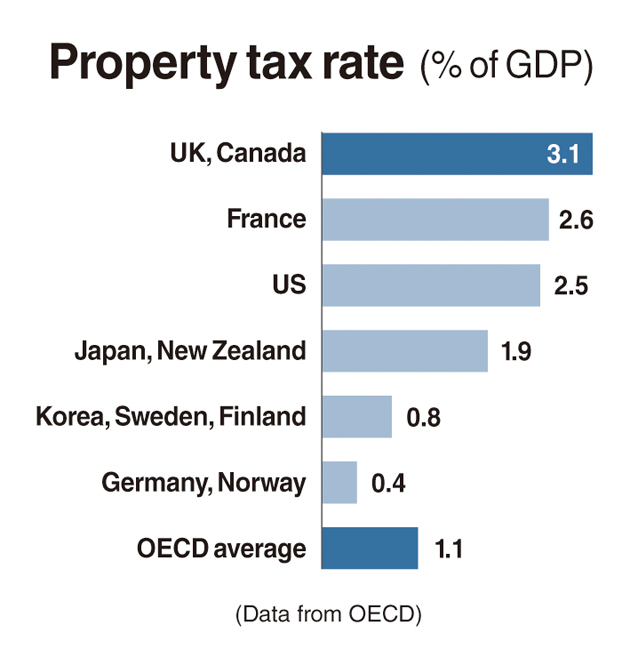

The housing prices in many of the Organizations for Economic Cooperation and Development member countries have kept increasing for the past years since the global financial crisis in 2008 although they maintain higher property tax rates; 3.1 percent in the United Kingdom, 2.5 percent in the US, and 1.9 percent in Japan, according to government-backed think tank Korea Institute of Public Finance.

The nation’s current average property tax rate compared with GDP stood at 0.8 percent, slightly lower than the average rate of 1.1 percent among the OECD member countries.

“The more advanced and capitalistic an economy is, the more its people tend to consider lands and houses as investment assets,” said Park Won-kab, a real estate analyst at KB Kookmin Bank,

OECD’s index on house prices has risen to 112.9 in the fourth quarter last year, the highest level since 2012. The index compares the prices of houses in the OECD member nations with base year 2010. Another set of data by research firm Gallup showed that the US, in particular, saw the housing prices rise 7.4 percent last year, compared to 4.8 percent from 2015 to 2016.

While giving kudos to the government-driven project to supply up to 1 million rental houses, some market researchers recommended government housing schemes be designed in an elaborate manner.

“The middle class was the one that took the brunt of the new housing regulations, which put focus on limiting loans, as it has become hard for them to borrow money from banks” said Heo Yoon-kyeong, a researcher at the Construction and Economy Research Institute of Korea, a think tank in the construction industry.

“More sophisticated measures should be prepared to embrace diverse social classes,” she said.

By Kim Young-won (wone0102@heraldcorp.com)

![[KH Explains] Korean shipbuilding stocks rally: Real growth or bubble?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=151&simg=/content/image/2024/04/25/20240425050656_0.jpg)

![[Hello India] Hyundai Motor vows to boost 'clean mobility' in India](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=151&simg=/content/image/2024/04/25/20240425050672_0.jpg)