Bio

Celltrion on track to resolve uncertainties

[THE INVESTOR] Celltrion has been solidifying its position as a leading player in the biosimilar industry here but regulatory setbacks from the US health agency and drug price competition continue to challenge its future prospects.

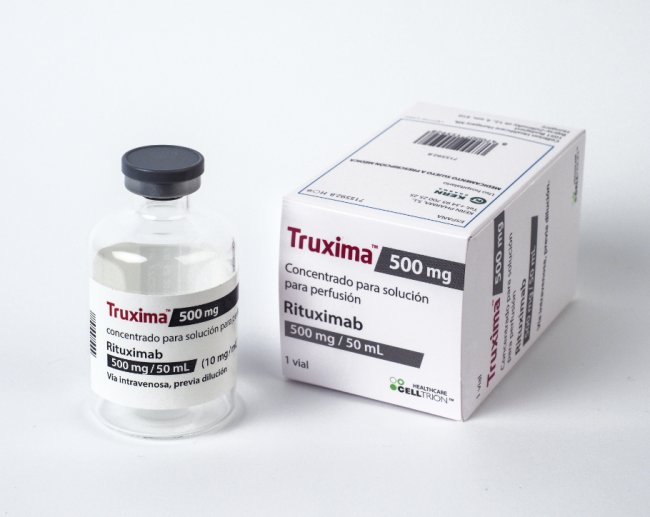

To brush off woes over the delay in receiving the Food and Drug Administration’s approval, Celltrion resubmitted its application for Truxima, its biosimilar version of Roche’s blockbuster cancer drug Rituxan on May 30.

|

“Celltrion already beat market estimates in submitting the requested supplementary materials for its Truxima before additional FDA due diligence at related production facilities. Moving forward, we believe that uncertainties on Celltion’s corporate structure and production facilities will steadily be eliminated,” said Ku Wan-sung, an analyst at NH Investment & Securities.

Below is the transcript of key issues raised by investors at a conference hosted by the Korean brokerage on May 29-31 in the US.

Q: What if Celltrion’s biosmilar products face price cuts similar to those for the original therapies?

A: The market dynamics for biosimilars differ from those for synthetic drugs. The latter have lower manufacturing costs and clinical costs than the biosimilar makers and face a lesser number of competitors.

For example, Teva is cutting the price for its flagship generic drug Copaxone by 50 percent in an effort to defend market share upon the launch of generic drugs.

In the US market, Celltrion’s Remsima is being sold at an average discount of 15 percent compared to the original, whereas its biosimilars Truxima and Herzuma were introduced in the EU market at an initial discount of 25 percent to the original drug -- this discount will be boosted to 35 percent in the year following their introduction and then to 45 percent thereafter.

Q: How is Celltrion dealing with the recent FDA regulatory issues?

A: Celltrion completed its submission of requested supplementary data for Truxima related to the FDA’s issuing of a complete response letter, notifying the firm that it had suspended the approval process for Truxima and Herzuma. With additional FDA due diligence over Celltrion’s production facilities scheduled for July and August, this submission of supplementary materials came earlier than US investors had thought possible. The submission of supplementary materials for Herzuma is scheduled for June. Assuming that there are no further requests for due diligence or issuing of additional warning letters in the coming months, Truxima and Herzuma appear on track to receive US approval in November or December.

Q: What is your take on the concerns toward Celltrion’s inventory and corporate structure?

A: Previously, US investors had worries about inventory and corporate structure issues, but they now appear to be fading. Based on Celltrion Healthcare’s annual sales of 1.5 trillion won (US$1.40 billion) in 2018, inventory totaling an estimated 1.6 trillion won should not present a notable problem.

Apart from this matter, many investors confuse issues at Samsung BioLogics with capitalization of R&D expenses issues at Celltrion. Of note, the Financial Supervisory Service has yet to present new guidelines or mandate related changes at Samsung BioLogics. Celltrion’s first quarter results show no significant changes in the way it handles its existing expenses.

Shares of Celltrion closed 2.56 percent lower at 266,500 won.

By Park Han-na (hnpark@heraldcorp.com)