Stocks & Bonds

[EQUITIES] ‘KCC to normalize in H2’

[THE INVESTOR] KCC posted solid earnings in the second quarter and will return to normal in the latter half, said DB Financial Investment on Aug. 8, maintaining a “buy” recommendation and 420,000 won (US$375.10) target price.

|

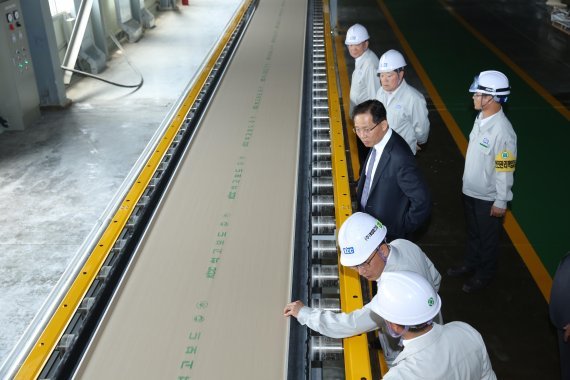

Its revenue in the period rose 3.5 percent on-year to 1 trillion won while operating profit fell 6.4 percent to 86.1 billion won, bearing the loss from declined value of stakes in Samsung C&T and Hyundai Heavy Industries. Its operating margin, however, improved to 8.6 percent. Increase in revenue from glass and gypsum boards and price rise of paints advanced its profitability, said analyst Cho Yun-ho.

Manufacturing capacity of glass and gypsum boards will increase in the second half as it has completed expansion. Stabilizing commodity prices and price rise will also boost its earnings, along with a low baseline effect in vessel paints, the analyst noted.

By Hwang You-mee (glamazon@heraldcorp.com)

![[Exclusive] Korean military set to ban iPhones over 'security' concerns](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=151&simg=/content/image/2024/04/23/20240423050599_0.jpg)