Finance

Korean banks beef up their overseas biz

[THE INVESTOR] Korean commercial banks are speeding up their overseas expansion as they seek new opportunities, with the latest data on Dec. 10 indicating that they are successfully ramping up their operations.

Woori Bank has expanded its global network fastest while Shinhan Bank’s overseas profitability grew the most in the first nine months this year, data showed.

Woori Bank, Korea’s fourth-largest by assets, has so far added 121 global offices in 2018, making the total number to 422 as of end-September. The rapid expansion was backed by its acquisition of VisionFund Cambodia, a small-loan focused financial firm in June. Founded in 2003, the company has 106 branches in the country. This is the second time in four years that the bank has increased its presence in the country after acquiring Woori Finance Cambodia.

|

Shinhan, the third-largest lender by assets, boasted a total of 163 overseas offices. It has added six overseas networks including ones in Mexico and Vietnam this year.

Hana Bank also launched 14 new offices, all in Myanmar, making the total number overseas to 160. Kookmin Bank, the nation’s largest bank, increased its overseas offices to 26 after setting up six new ones -- four in Myanmar and two in Cambodia.

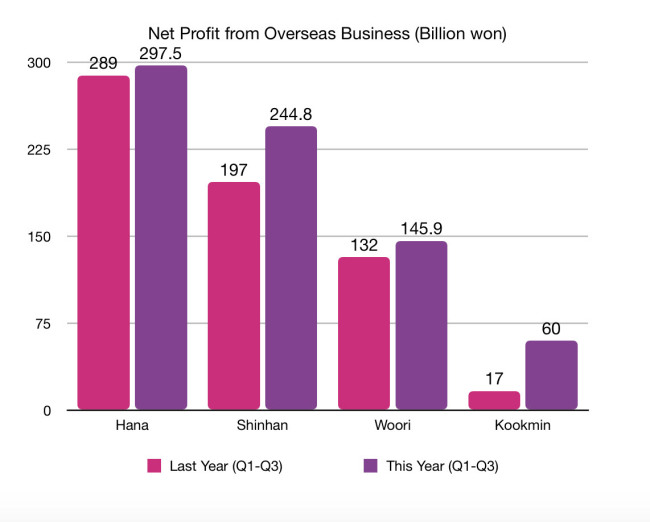

Hana Bank, the second-largest lender by assets, proved to be most profitable with a net profit of 297.5 billion won (US$264.33 million) from its overseas units in the first nine months. But it grew less than 3 percent from the same period last year.

Sinhan saw the biggest leap in net profit from its overseas business, jumping 24.4 percent to 244.8 billion won in the period from a year ago. The proportion of its total profit from overseas also grew to 12.8 percent this year from 11.6 percent a year ago.

The growth was mainly backed by Shinhan Bank Vietnam which has 900,000 clients, the largest among foreign banks. It accounted for 31 percent of its total overseas net profit for the first nine months this year. It had bought the retail finance division from ANZ Bank (Vietnam) bank last year and has launched credit loan services.

|

KB Kookmin Bank, whose global business is the smallest among top five commercial banks, saw a tripling of its net profit.

Korea’s local banks are increasingly seeking overseas opportunities especially in developing countries such as Cambodia and Indonesia as domestic profitability stagnates. The trend is likely to continue and expand next year as some local banks plan to go as far as South America, according to analysts.

Woori Bank said it plans to expand its network in China after completing its transformation into a holding company structure next year. When Sohn Tae-seung took the realm as CEO last year, the bank revealed an ambitious goal of 500 overseas offices.

Shinhan, which targets to earn more than 500 billion won outside Korea by 2020, established Shinhan Bank Mexico, a wholly owned subsidiary, in March, becoming the first Korean bank to enter South America.

Hana Bank is preparing to open a Mexican subsidiary in its efforts to diversify its global regional portfolio. It aims to increase profit contribution from overseas businesses to 40 percent by 2025.

“We will continue to fine-tune and pursue our strategy to go global,” said a Hana Bank official. “Digital transformation will be an important part of our global expansion.”

By Park Ga-young (gypark@heraldcorp.com)