Market Now

Fintech platforms become major banking tool for young Koreans: survey

|

A survey of 2,000 Koreans in their 20s and 30s shows that fintech platforms are the most used method for easy money transfers. (KorFin) |

More than 90 percent of Koreans in their 20s and 30s use fintech platforms for money transfers instead of going to bank branches, a survey showed on July 12.

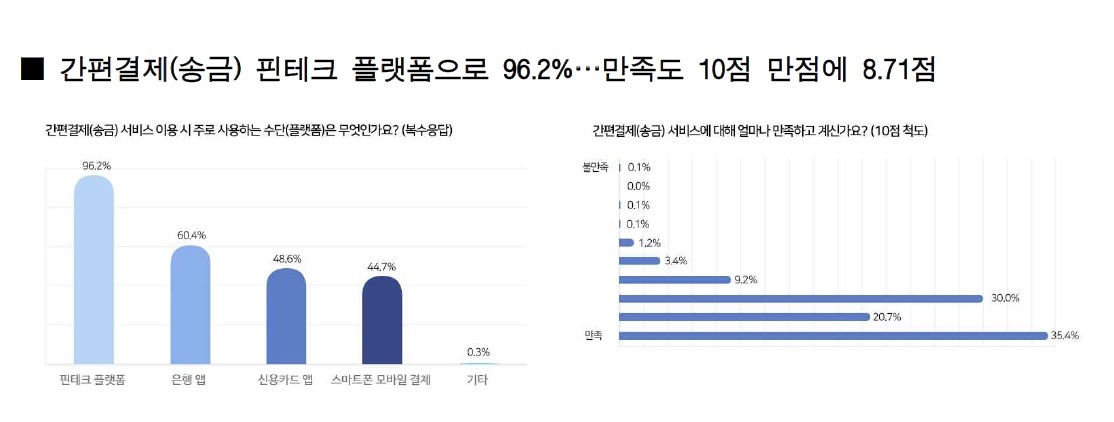

According to the survey conducted by the Korea Fintech Industry Association, about 96 percent of respondents said they use a financial technology platform developed by nonfinancial companies such as Kakao, Naver and Toss, while 60 percent said they use banking apps. The survey asked 2,000 people in their 20s and 30s who use payment services to gauge their preference and level of satisfaction. In addition to the fintech platforms and bank apps, 48.6 percent said they use credit card apps and 44 percent pay via services developed by IT giants Samsung and LG.

In terms of service satisfaction, they gave 8.71 out of 10, with 34.5 percent of the respondents awarding the full score.

“Fintech has promoted competition and innovation and resolved imbalances in information distribution and as a result, we are in a transitional period of power shift from financial companies to customers,” Ryu Young-joon, the chairman of KorFin said.

“I look forward to further improvement in financial consumers’ sovereignty in many ways through the revision of the Electronic Financial Transactions Act, which is the foundation law of digital finance in the future,” said Ryu, who is also the CEO of Kakao Pay.

The Electronic Financial Transactions Act allows mobile platforms, including online giant Naver and messenger app operator Kakao, and other financial institutions such as credit card companies to offer comprehensive payment and settlement services.

By Park Ga-young (gypark@heraldcorp.com)