Market Now

Meet the market winners and losers in times of pandemic

The South Korean financial and investment market has been going through probably the biggest and fastest change in its modern history under the COVID-19 pandemic, which still shows no sign of abating.

It may not be the case just for Asia’s fourth-largest economy, as global markets as a whole have also been greatly touched by the spread of the virus and a series of expansionary fiscal measures, as well as the lockdowns that followed. What appears to have made the Korean market unique in terms of the virus-triggered industrial shift is in its speed of the change itself, and the magnitude of market participants embracing such unprecedented transformation thanks to the world’s most-wired country’s expansive information technology infrastructure, and perhaps, the infamous “hurry, hurry” culture.

Here’s a look at the biggest winners and losers, analyzed by the Investor team of The Korea Herald and a preview of what the prolonged pandemic might bring.

WINNERS

|

A customer checks in with a temporary QR code embedded in smartphone before entering a department store in Seoul. Korea‘s QR check-in mandates led to wider adoption of online payment and banking. (Yonhap) |

Fintech

South Korea had been considered a late starter in the development of financial technology firms compared to other players in advanced markets, but the pandemic has allowed fintech companies to catch up with their international rivals. Why? Various industries are increasingly relying on online payments as consumers shop online more than ever before.

Daily transactions using easy payments rose an average of 449.2 billion won ($384.6 million), 41.6 percent up from the previous year. Electronic financial business operators such as Kakao Pay and Naver Financial accounted for 45.7 percent of the total transactions.

In addition, even in the offline payment area, payment companies appear to be the winner, partly because of COVID-19 check-in mandates. Before that, South Korea was far behind China when it came to QR payments. Ryu Young-joon, CEO of Kakao Pay, said QR check-ins helped boost the adoption of QR payments in-person, enticing Korean customers more accustomed to using credit cards, and that would likely stay the norm even after the pandemic.

In Korea, fintech companies such as Kakao Pay and Toss that specialize in digitization saw better-than-expected growth. Kakao Pay is expected to go public later this month, while Viva Republica, the operator of fintech app Toss, reached a whopping 8.2 trillion won in corporate valuation for its latest funding round.

In terms of banks, who are competing with up-and-coming fintech companies, online-only banks shined. KakaoBank went public earlier this month, while K bank had a turnaround in the second quarter. This draws a stark contrast to the growing number of closures of physical bank branches across the country. Granted, the decreasing number of bank branches started quite a while ago, but the pandemic has sped up that trend.

|

Venture investments

One might think extended social distancing and remote work would hinder investment activities such as due diligence and meetings between founders and venture capitalists. Yet despite these obvious hindrances, data shows that the venture capital industry in Korea has been unstoppable, even as the pandemic rages on. In the first half of this year, venture capital firms grew 128.3 percent from a year ago to a record-high 404 billion won. The figure surpassed last year’s total of 227 billion won, when the first wave of the pandemic struck the local industry.

In this overall upbeat market sentiment, those companies providing products and services that facilitate contactless lifestyles spurred by the COVID-19 pandemic outbreak are seeing a growing influx of investments from venture capital.

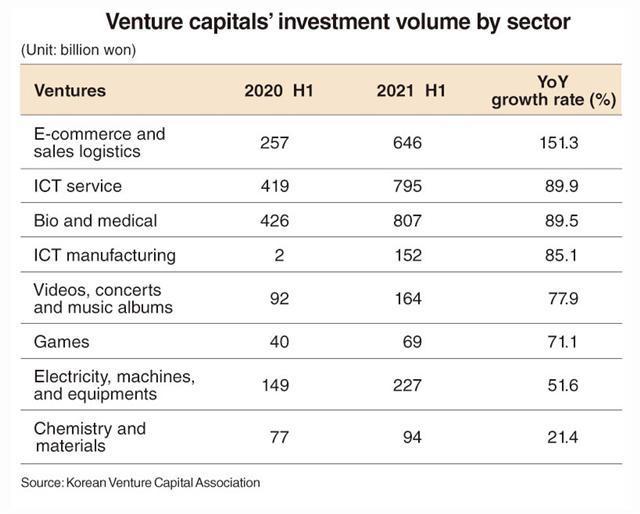

Startups in the bio and medical sector, e-commerce platforms and logistics and the information and communication technology services sector were their favorite destinations, according to data from the Korean Venture Capital Association.

Investments in e-commerce and logistics firms surged by 151.3 percent to 646 billion won in the first half of this year, largely due to the spike in online shopping.

ICT services companies in 5G, artificial intelligence, big data and software development saw the second-steepest hike of an 89.9 percent increase in capital flow. Alongside growing interest in COVID-19 vaccines or biosimilars of pharmaceutical giants, bio and medical ventures saw 807 billion won of fresh investments coming in the first half.

|

A digital board at the Korea Exchange shows KakaoBank’s IPO on Aug. 6. (Yonhap) |

Stocks

When the country’s main bourse and secondary index both hit their lowest points in nearly 11 years in March last year, with the Kospi closing at 1,457.64 points and Kosdaq closing at 428.35 points as the pandemic crashed the market, no one would have predicted the monthslong upward movement.

But backed by the “Donghak Ant Movement,” referring to a stock buying spree driven by retail investors, the country’s benchmark Kospi soared above 3,300 points, while the tech-heavy Kosdaq traded above the 1,000-point level in the first half of this year, more than 20 years after the dot-com bubble burst.

As of August 13’s close, the Kospi and Kosdaq had jumped 122.5 percent and 143 percent from their recent bottoms, respectively.

|

Companies eyeing initial public offerings were quick to take advantage of the bullish market, moving up their public listing plans. So far this year, 46 firms, barring real estate investment trusts and special purpose acquisition companies, made their debuts, according to Korea Exchange data. A view of Seoul and Gyeonggi Province from Seoul Tower (Yonhap) Housing The unstoppable apartment price increases in Seoul have driven the highest growth of 0.2 percent on-week as of Aug. 2, according to data released by Korea Real Estate Board. Apartments in Gyeonggi Province, surrounding Seoul, also rose 0.47 percent on-week. It was the biggest rise since the state-run company began providing statistical data in May 2012. Meanwhile, apartment prices nationwide showed an increase of 0.28 percent, a six-month high, during the same period. Followed by high demand for home-backed lending and an investment frenzy, people’s credit-based loans and bank debt in the country jumped rapidly. According to the Bank of Korea, outstanding bank loans to Korean households marked 1,040.2 trillion won as of end-July, up 9.7 trillion won from a month prior. It was the largest on-month gain for July since the central bank began compiling related data in 2004. The solid growth resulted from a sustained rise in mortgage loans and credit lending, the central bank said. More loans mean more interest income for lenders, who recorded all-time high interest earnings of 15.46 trillion won, combining the five major commercial banks here -- Woori, Shinhan, KB Kookmin, NH NongHyup and Hana -- in the first half, recording the first time for them to exceed 15 trillion won on a quarterly basis, according to the industry. The earnings of 18 local banks also amounted to 8.6 trillion won in the first half, up 2.1 trillion won from the previous year, recent data from the Financial Supervisory Service released Wednesday showed. Cryptocurrency A visual concept image of Bitcoin (Yonhap) Virtual assets were regarded as among the favorite investment destinations for day traders at home and abroad, as issuers often proclaimed that they were using promising blockchain technologies to build the new future of finance. Adding fuel to the crypto fever were the relatively loose regulations on cryptocurrencies and retail investors’ ease of access to their assets. Moreover, there were signs earlier this year that virtual assets were becoming mainstream, as US companies such as Tesla, PayPal, Mastercard and Bank of New York Mellon announced plans to adopt cryptocurrencies as a viable means of payment. But the rosy promises are giving way to virtual assets’ extreme level of price sensitivity and volatility around the clock, leaving day traders fatigued.

Their combined market capitalization stood at 114.7 trillion won as of August 10, surpassing 100 trillion won for the first time on a yearly basis. That accounted for nearly 4.4 percent of the accumulated market valuation of listed firms in both markets of nearly 2,800 trillion won here.

The boom in the market also created another winner: brokerage firms. Local brokerages have been posting record gains since last year. The combined net profit of 57 brokerages came to 2.98 trillion won in the first quarter, compared to a profit of 1.58 trillion won a quarter ago, thanks to the market rally that helped them earn higher commission fees.

The interest earned from lending money to clients by six major securities firms -- KB Securities, NH Investment & Securities, Mirae Asset Securities, Samsung Securities, Kiwoom Securities and Korea Investment & Securities -- came in at 297.8 trillion won in total as of end-June, up 124 percent from a year earlier, KOFIA data showed.

Though the stock market has grown in size, not all sectors have benefited from the unprecedented pandemic. Although market bellwether Samsung Electronics and No. 2 SK hynix maintained their top positions in terms of market valuation, the rest of the top 10 Kospi stocks, excluding preferred stock, shuffled in the rankings.

Fueled by the contactless boom across the country, internet giants Naver and Kakao saw their market cap rankings climb, besting previous second and third runners-up LG Chem and Samsung Biologics. Stocks in secondary batteries, biopharmaceuticals, online gaming and IT have gained much attention from investors, experiencing a surge in their stocks. On the contrary, stocks listed in traditional sectors such as oil refining, shipbuilding and steel were turned away.

If you call something a winner because of an upward movement in price, then the housing market is a champion. Despite the government’s warning signals, nationwide housing prices have been gaining for 23 months.

LOSERS

|

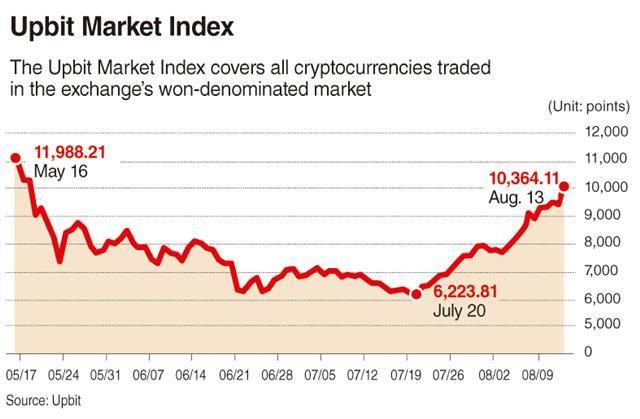

The broad-based Upbit Market Index, which tracks all cryptocurrencies trading on the won-denominated market, fell about 14 percent over the course of three months through Friday, with the recovery in the past few weeks partly eclipsing earlier losses, according to Korea’s largest cryptocurrency exchange Upbit.

This is in line with the price movement of Bitcoin, the world’s first and largest decentralized digital currency by market cap. Once trading at over 80 million won apiece in mid-April, that price was at 53.5 million won late Friday afternoon.

Gold

|

A promotional image for gold bullions (The Korea Exchange) |

Gold is considered a safe haven in eras of uncertainty, playing the role of a popular hedge against the general price movements of financial assets.

But with signs of a global economic recovery followed by vaccination hopes, as well as ample financial liquidity that has offset market uncertainty, the precious metal has lost steam and been shunned by liquidity-backed investors.

According to market operator the Korea Exchange, the spot price of pure gold was quoted at 66,220 won per gram on Friday. The price fell over 10 percent in the past year, and had shed 0.2 percent since January.

This is attributable to the sizable outflow of gold exchange-traded funds for six months through the first quarter of 2021, according to a July report from the World Gold Council. The gold price recovered with the return of gold ETF inflow in the second quarter, the report also showed, but fell short of recouping losses earlier the same year.

A similar downtrend was seen in ETFs tracking gold futures. For example, Seoul-based Samsung Asset Management’s Kodex Gold Futures ETF, which uses the S&P GSCI Gold Index as its benchmark, was 11 percent lower than a year prior and had dropped 8 percent by Friday from January.

Coal-related stocks

|

The theme of environment concern has been raging in worldwide investment circles as the coronavirus pandemic triggered worries of a sustainable future. This has led to more global institutional investors joining the race to adopt negative screening policies to rule out coal-related financing.

Against this backdrop, those who are lagging behind in Korea, which last year declared a goal of achieving carbon neutrality by 2050, have seen their stock prices tumble over the past few months, although direct links between their coal exposure and stock price movement might be unclear.

For example, the state-run Korea Electric Power Corp., currently engaged in ongoing coal projects in Vietnam, Indonesia and domestically, barely benefited from the bullish trend in the domestic stock market, as its stock price has only just returned to the pre-COVID-19 level. Its share price -- 24,750 won on Friday -- remains lower than at the end of 2019, when it sat at 27,800 won.

Other Korean companies with coal exposure are taking a bearish turn from the second quarter. Shares of Posco and LX International have been on a downward trend since May, while those of Doosan Heavy Industries & Construction, GS Global and SK Gas have been bearish since June.

Hotels

|

Sheraton Seoul Palace Gangnam Hotel (Sheraton Seoul Palace Gangnam Hotel) |

From the viewpoint of institutional real estate investors, hotels and other accommodation facilities have been a headache during the virus outbreak. Travel restrictions due to the pandemic are dealing a severe blow to the hotel business.

The same is true in Korea.

The Korean property market is witnessing growing demand for investors to convert hotels into residential or commercial buildings, which would likely be more resilient during the pandemic.

In 2020, nine of 22 deals were carried out with the intention of converting the hotel properties to residential use, according to an estimate by real estate service firm GenstarMate.

Luxury hotels are no exceptions, as Sheraton Seoul Palace Gangnam Hotel, the first five-star hotel in Seoul’s affluent district of Gangnam that was sold last year, is poised to be transformed into a residential building.

More property investors are weighing the trend in order to improve the property’s cash flow. One latest example is Glad Live Gangnam Hotel, as a proposed buyer looks to reopen the hotel after building an office property in its idle space.

Some sellers, however, have acted out against the trend. CDL Hotels Korea, owner of Seoul’s landmark hotel Millennium Hilton Seoul, withdrew its plan to sell the hotel asset in June, as proposed buyer Igis Asset Management reportedly sought to convert it into an office building.

Equity crowdfunding

When the pandemic effect meets with market restrictions, it could accelerate downfalls. Once a fast-growing means of fundraising for early-stage startups, equity crowdfunding is now largely being given the cold shoulder by liquidity-rich investors in Korea, who see better opportunities in sectors such as the stock and crypto markets.

Twenty-eight startups have raised a combined 5.2 billion won from January to June via equity crowdfunding. This is equivalent to only 20 percent of the full-year equity crowdfunding of 2020 at 23.7 billion won, according to data compiled by the Korea Securities Depository. The 2020 figure itself had already shrunk by 36 percent from the previous year.

Aside from the impact of the pandemic, the nation’s equity crowdfunding scene, led by platforms such as Wadiz and Crowdy, faces regulatory hurdles amid criticism over limited retail investor access, an upper cap in the investible amount of capital and the nonexistence of a secondary investor market for crowdfunding investors.

Rep. Min Hyung-bae, a lawmaker with the ruling Democratic Party of Korea, proposed a revision of the Capital Markets Act in November 2020 to deal with the challenges.

Offline banks

|

A notice at a local bank branch announces the branch’s closure and merger into another branch. (Yonhap) |

Social distancing measures across the nation have forced financial consumers to adopt a new culture of digital banking. In the wake of the new trend, brick-and-mortar bank branches are playing a less significant role in consumer banking tasks.

Against this background, Korean banks are in a race to shut down bank branches to achieve cost-efficiency and double down on digitization efforts in order to compete.

As of end-March, Korea’s six commercial banks, six provincial banks and five specialized banks operated a combined 6,366 branches and offices nationwide, down 266 -- or 4 percent -- from the previous year, according to data from the Korea Federation of Banks. The pace of shutdowns was comparatively slower in 2018 and 2019, when the numbers were in the 6,700s.

The KFB data also showed that nearly 200 shops had closed during the past six months to March.

Now, financial authorities are moving to slow the pace of branch removal for the sake of the marginalized groups such as senior citizens.

The Financial Supervisory Service, Korea’s financial watchdog, expects banks to slow down the accelerating pace of branch shutdowns with toughened regulations -- requiring banks to undergo a third-party review for branch shutdowns -- which took effect on March 1.

By The Investors Team