Retail & Consumer

YG Entertainment, fly or fail?

[THE INVESTOR] YG Entertainment, one of Korea’s leading entertainment powerhouses, is facing one of its worst times.

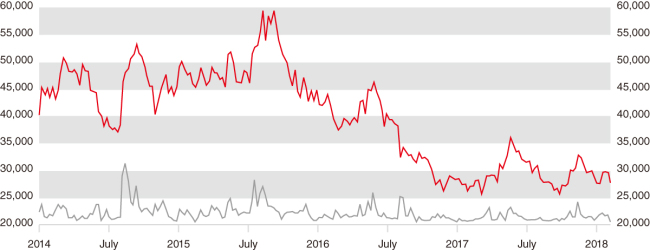

Market value is tumbling -- its stock price is at about a third of that in 2012 -- and its earnings are far from stellar. However, industry watchers warn that the worst has yet to come, as they believe the effect from a host of negative factors including the departure of YG’s prized cash cow Big Bang and singer Psy, along with an underperforming subsidiary and a series of failures by in-house entertainment shows will be reflected in earnest starting from the next quarter.

Sagging stock value and earnings

|

Stock price of YG Entertainment |

On May 30, YG shares closed at 28,550 won (US$26.49). This is close to half the value that L Catterton Asia (then L Capital Asia), the Asian private equity firm backed by LVMH Moët Hennessy Louis Vuitton, paid when it invested US$800 million in September 2014.

L Catterton Asia’s investment in YG was its first investment in Korea. The deal included a redeemable convertible preference shares tranche of US$60 million. L Catterton Asia has rights to sell its 1.4 million shares for 48,000 won apiece on Oct. 16, 2019, or convert them into regular shares at the market price at any time. But it looks like the firm won’t have much of an incentive to convert soon, given YG’s sagging share price.

Further, it looks like the money wasn’t spent too wisely by YG, which bought a 39.5 percent stake in Phoenix Holdings for 50 billion won. The firm was renamed as YG Plus, a subsidiary dealing in cosmetics, fashion and food, and is in the red for the past six years.

In the first quarter of this year, YG grossly underperformed market estimates.

Revenue fell 27.7 percent on-year to 77.3 billion won (US$71.80 million) compared to a market consensus of 88.1 billion won. Operating profit took a deeper dive, plunging 84.4 percent to 2.3 billion won. The market consensus had been 9.1 billion won.

|

What happened?

To be fair, it was not all YG’s fault.

There was the THAAD row with Beijing that had slammed the door on the faces of many K-pop stars. Then several of the Big Bang members had to serve in the military -- a mandatory service for all able-bodied Korean males. T.O.P, the oldest member of Big Bang, joined in February 2017, followed by Taeyang, G-Dragon and Daesung earlier this year.

The absence of the 13-year-old group has led to a big dent on YG’s bottom line. From 2014 to 2017, Big Bang was responsible for more than half of YG’s albums sold in Korea.

Younger and newer additions to YG such as iKon, Winner and Blackpink are pulling their weight, but they still fall far behind Big Bang. “We believe these three are basically doing well, but their concert ticket sales in Japan this year is expected to reach only 37 percent of Big Bang’s sales of 1.44 million last year,” Park Jeong-yeob, an analyst at Mirae Asset Daewoo Securities, wrote in a report on May 14.

YG’s attempts to expand its business scope was also not too successful. Its signature audition program “Mixnine” incurred losses of 7 billion won in the first quarter and 4 billion won in the last three months of 2017.

|

Big Bang |

Looking ahead

Addressing the growing concerns over the company’s prospects, Yang Hyun-suk, founder and chairman of YG, last week shared plans on a new generation of artists to revive investor sentiment including new album releases of Blackpink, Big Bang’s Seungri, iKon and Winner.

More new artists will be introduced next year he said. He also announced plans to set up a subsidiary called YGX. The new unit will manage YG’s dance academy. The firm also plans to launch a new program called YG Future Strategy Office on Netflix.

There is hope, industry watchers say, referring to SM Entertainment, which made a successful transition under similar circumstances. When TVXQ and Super Junior were on hiatus due to military service, the fan base for new artists -- EXO and SHINee -- expanded rapidly to become a promising revenue source in 2018, according to Park of Mirae Asset.

By Park Ga-young (gypark@heraldcorp.com)