Stocks & Bonds

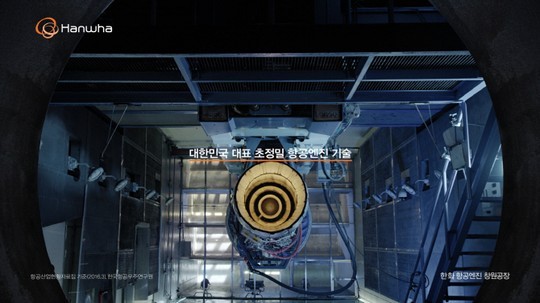

[EQUITIES] ‘Hanwha Aerospace to outperform in Q4’

[THE INVESTOR] Hanwha Aerospace will beat market expectations in the fourth quarter, said Kiwoom Securities on Dec. 18 raising the target price to 42,000 won (US$37.14) from 40,000 won.

|

Its operating profit in the period will rise 56 percent on-year to 72.5 billion won, widely surpassing market consensus. Its subsidiary Hanwha Land Systems is concentrating on exports and its profitability has significantly improved. It will gain from merger of the ICT divisions while Hanwha Techwin will enjoy the effects of reshuffling especially in B2B area, said analyst Kim Ji-san.

Hanwha Techwin and Hanwha Systems will propel its earnings improvement next year and merger of Hanwha S&C and the group’s acquisition of aircraft and tools machinery businesses will be fully reflected, he said raising the operating profit estimates for 2019 to 143.7 billion won.

By Hwang You-mee (glamazon@heraldcorp.com)