Startups

Yanolja hopes to raise US$300m from overseas

The operator of Korea’s No. 1 accommodations booking app Yanolja is looking to raise US$300 million or more from foreign investors by selling equity, according to industry sources on Feb. 8.

|

Related:

Yanolja hires former Tesla Motors Korea chief

Yanolja named most popular accommodation app in Korea

Yanolja to acquire Singapore-based startup Zenrooms

Up for sale are some 15 percent of existing shares owned by financial investors not identified to the public, roughly valued at 150 billion won (US$133.5 million), plus newly issued stocks for third-party allotment worth US$200 million. Morgan Stanley has been selected to manage the equity transactions.

Financial investors who hold a combined 48.96 percent of Yanolja include Seoul-based venture capital and private equity firm SkyLake Investment, which invested some 60 billion won in June 2017, as well as SBI Investment Korea and Hanwha Asset Management. Investors and Morgan Stanley was not immediately available for comment on the matter.

Founded in 2005, Yanolja has provided on-demand services involving over 17,000 accommodations facilities both at home and abroad. As of June 2018, Yanolja had some 9.1 million subscribers and recorded 23.6 million downloads of the mobile app -- highest in the country in both categories.

|

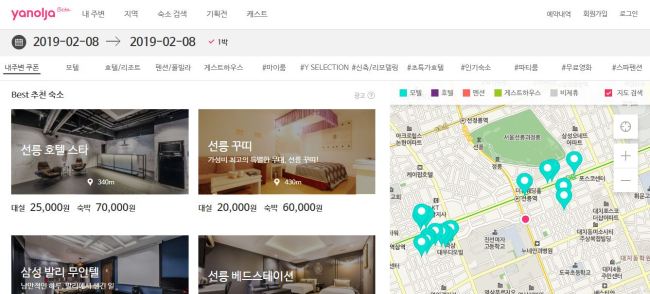

A screen snap of Yanolja's online accommodation booking service |

Yanolja’s desire to expand overseas was reflected in its previous move to acquire Singaporean startup Zenrooms. It also signed on for a partnership with Japanese online travel agency Rakuten Lifull Stay and Irish hostel operator Hostelworld.

In the past three years Yanolja has received a combined 150 billion won in funding from financial investors. But its bottom line has not been great. In three years from 2015 to 2017 it posted operating deficits. Losses widened to 11.6 billion won in 2017 from 7.5 billion won in 2015.

Since 2018, Yanolja has been looking to go public. It picked Mirae Asset Daewoo as an underwriter for its initial public offering.

By Son Ji-hyoung (consnow@heraldcorp.com)