Finance

Accumulated P2P lending exceeds W6tr

Accumulated peer-to-peer loans in South Korea have surpassed 6 trillion won ($5 billion), data showed on Sept. 26.

Outstanding P2P loans extended by 220 companies stood at 6.2 trillion won in June, compared with 4.7 trillion won at the end of last year, according to the data compiled by the Financial Supervisory Service.

|

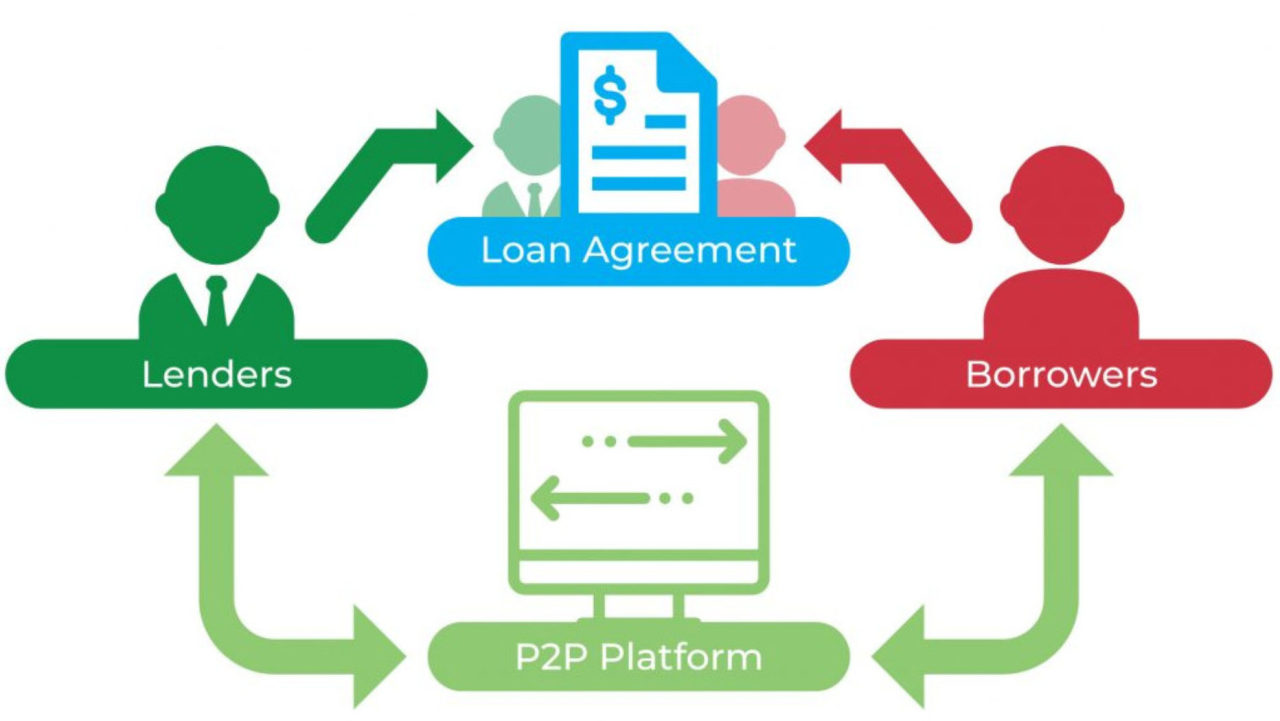

P2P lending is a new type of loan extended to individuals or businesses through social networks and the Internet, covering a wide range of services, including loans to startups and self-employed businesspeople.

Delinquencies among P2P lending firms have risen, according to the data.

The average delinquency ratio of P2P lending firms stood at 11.98 percent in June, compared with 10.89 percent at the end of last year.

The rise in P2P delinquencies came as such firms’ lending to property development projects turned sour over the government’s regulations aimed at cooling home prices.

Lawmakers have proposed bills to regulate P2P lending firms, but the bills have gained little momentum in the National Assembly.

With the bills pending, financial authorities have been struggling to tackle abusive and deceptive P2P lending practices.

Financial authorities have said disputes between investors and P2P lending firms were on the rise and some P2P firms were raising funds illegally.

Lax regulation on entry into the P2P sector is one of the reasons for such problems, officials said.

By Ram Garikipati and newswires (ram@heraldcorp.com)