Finance

Kakao Games aims to raise up to W384b on stock market debut

The game developer is offering around 16 million new common shares in the price band of 20,000-24,000 won, CEO Namkoong Whon said in an online press conference. Targeting institutional investors, book building is to take place on Wednesday and Thursday to determine the exact share price. Subscriptions will be accepted Sept. 1-2 with Korea Investment & Securities and Samsung Securities serving as the underwriters of the IPO.

|

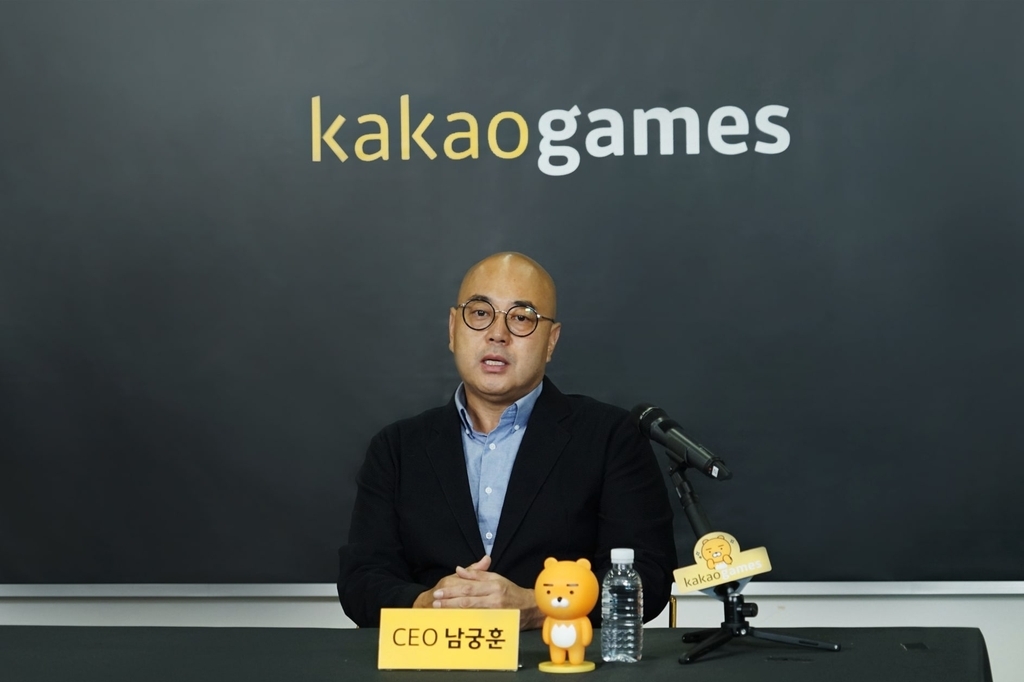

Kakao Games CEO Namkoong Whon speaks at an online briefing with reporters on Wednesday. (Kakao Games) |

Under the plan, the firm’s market capitalization after listing is anticipated to reach between 1.5 trillion won and 1.8 trillion won. If successfully achieved, the deal will become the biggest of its kind in Kosdaq in the second half of this year.

“Owning powerful mobile and PC platforms, Kakao Games is the only local game company that has formed a value chain of publishing and developing games,” Namkoong said.

Previously, the game developer was reportedly aiming to make a stock market debut in the second half of 2018, but put off its initial plan due to the sluggish stock market and a delayed review on Kakao Games’ IPO scheme by the Korean Institute of Certified Public Accountants.

“(As we resumed the IPO process this time) We thought about possible changes in the gaming industry in the so-called ‘post-coronavirus’ era. Due to the ongoing virus pandemic, many game development projects around the globe have either been delayed or entirely scrapped,” the CEO said.

“Contrary to other game developers overseas where nearly all gaming firms have stopped producing games, Korean firms have steadily launched new games in this challenging period. Therefore, I thought now is a good time for local game developers, and Kakao Games can get a big chance as well.”

The IPO proceeds will be used to pave the way for Kakao Games to boost its presence in global game markets, taking over game developing firms, securing new game lineups by obtaining new gaming intellectual property rights and #making investments to expand businesses in overseas markets.#

After merging with Daum Games in 2016, the 4-year-old game company has shown outstanding growth. In the first half of this year, Kakao Games’ operating profit marked 28.7 billion won, up 63.7 percent on-year. Its net profit also jumped by 264 percent on-year to 27.8 billion won, while its sales rose 8.2 percent to 203 billion won in the given period.

The three-year compound annual growth rate of the game developer recorded about 57 percent. Much of growth is further expected in the near future amid its remarkable development ability and various new businesses, besides game businesses, according to the company.

“Our business performance in the second half of this year is expected to grow even more than the first half,” said Kakao Games Chief Financial Officer Kim Ki-hong. “Guardian Tales, which launched in July, has shown good performance in and out of Korea. While The Legendary Moonlight Sculptor is slated to launch in Greater China in the fourth quarter, massively multiplayer online role-playing game, or MMORPG, Elyon is also getting ready to launch in Korea.”

In the meantime, market watchers’ expectations of the first Kakao subsidiary firm’s IPO are also growing. Despite its low offering price of some 20,000 won, the firm is forecast to rank among the top 20 by market cap on the tech-heavy market.

Buoyed by expectations in the game industry amid the coronavirus outbreak, Kakao Games’ value on the pre-IPO market has soared recently. According to over-the-counter information provider 38 Communication, the highest stock prices of Kakao Games in the recent five weeks marked 69,500 won. As of Wednesday, shares of Kakao Games were trading at 63,500 won, nearly threefold its offering share price range.

“Based on in-depth discussions with the IPO underwriters, we’ve decided the price band on the level that we could give trust to our potential shareholders. We believe that stock prices after listing, however, will be determined by the market and investors,” Kim added.

By Jie Ye-eun (yeeun@heraldcorp.com)