Economy

Surplus funds surge at companies, sink at households

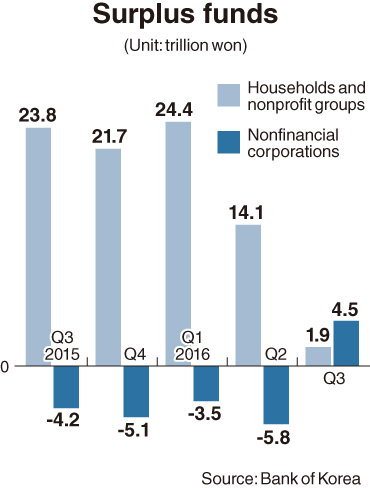

[THE INVESTOR] Data released by the Bank of Korea last week showed surplus funds held by the country’s households are rapidly decreasing, while corporations sit on a mounting pile of cash reserves.

Excess funds held by local households and nonprofit organizations, including consumer and charity groups, totaled 1.9 trillion won ($1.57 billion) in the third quarter of this year, markedly down from 14.1 trillion won in the previous quarter. It showed the smallest sum since the BOK began compiling relevant data in 2009, based on new international standards.

|

Excess funds refer to the amount of money that remains on the balance sheet after being spent, deposited and invested in stocks and other financial assets.

The central bank cited increased spending on housing as a main reason for the steep drop in households’ surplus funds.

By contrast, nonfinancial corporations here held 4.5 trillion won in excess funds in the cited period, compared to a shortage of 5.8 trillion won three months earlier. It was the first time South Korean companies as a whole, including public firms, have gotten out of fund shortages since 2009.

Public corporations held 6.4 trillion won in excess funds, while private companies had a shortage of 1.9 trillion won, compared to the 5.4 trillion won deficit in the previous quarter.

During the July-September period, local companies raised 5.3 trillion won by borrowing from banks and issuing bonds and stocks. The figure was a sharp drop from the usual amount in previous quarters, which ranged from 20 trillion won to 30 trillion won.

As of the end of September, the country’s 100 largest corporations in terms of market capitalization retained about 55 trillion won in surplus funds, more than double the figure a year earlier.

In the third quarter, household debt rose by 38 trillion won to exceed 1,500 trillion won.

Economists say this deepening contrast between financial conditions of corporate and household sectors heightens the need to encourage companies to expand investments and help increase family income.

These policy efforts are crucial to bolster the country’s faltering economy in the long term.

The government last week revised down its growth forecast for 2017 from its initial target of 3 percent to 2.6 percent, which private research institutes see as too rosy. Some economists warn that the growth rate may tumble below 2 percent as a slowdown in domestic demand is likely to be coupled with a slump in exports.

Private consumption and construction investment were the main contributors to the 2.6 percent expansion of the country’s economy last year, when exports fell by 6.1 percent and facility investment decreased by 3.3 percent.

Experts note overhauling the country’s business environment is needed to boost entrepreneurship that has been depressed by political influence and excessive regulation.

In a recent survey of 800 South Korean adults, conducted by a local economic research institute, more than 52 percent of the respondents cited meddling by political circles as the biggest factor hampering corporate activities.

An index of the country’s entrepreneurial spirit, measured by the Korea Economic Research Institute, plummeted to 86 last year from its peak of 220 in the late 1980s.

As a way to pre-empt undue pressure on businesses, Kim Yong-chul, a professor at Pusan National University, proposed obliging powerful officeholders to report details of their work to the Government Public Service Ethics Committee on a quarterly basis and disclosing them later.

A move by some lawmakers toward enacting a law to prevent quasi-taxes on corporations, which amounted to 16.4 trillion won, excluding social insurance, last year, has drawn support from the public.

Corporations are also under mounting pressure to do their part to sever collusive links with political circles by making corporate governance transparent and putting an end to seeking profits through illicit means.

“A large amount of punitive damages need to be sought to force companies to suffer huge losses when they earn profits illegally,” said Sung Tae-yoon, an economics professor at Yonsei University.

The Federation of Korean Industries, the main business lobby which served as a conduit for corporate donations to two nonprofit foundations controlled by a confidante of President Park Geun-hye, faces the possibility of being disbanded as some corporations under investigation regarding the influence peddling scandal have decided to leave the organization.

Whatever the outcome, this atmosphere should lead to cutting the cozy ties between political and business circles, economists say.

It may be difficult to expect companies to increase investment as domestic political turmoil has added to uncertainties surrounding businesses at home and abroad.

A majority of South Korean companies expect their business conditions to deteriorate in the coming month, with the business survey index for January at 89.9, down from 91.7 last month. A reading below 100 suggests pessimists outnumber optimists.

Economists say, however, measures to help boost corporate investment should top the list of tasks to be undertaken by the current economic team and the next administration, which might take over in the early part of this year, depending on the outcome of the Constitutional Court’s ongoing review of the parliamentary impeachment of Park.

Promoting corporate investment that would result in creating more jobs might be the most effective way to increase income for households, particularly those in the low income bracket, whose earnings have decreased in recent years.

By Kim Kyung-ho/The Korea Herald (khkim@heraldcorp.com)