Samsung

[SHARP SHOCK] Sharp-Samsung face-off jeopardizing industry order

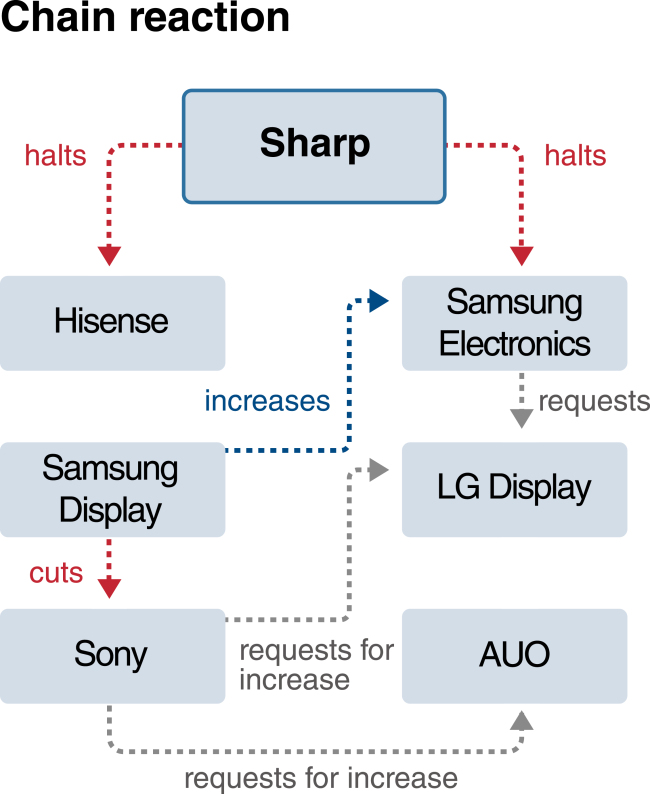

[THE INVESTOR] Sharp’s sudden supply halt to Samsung Electronics is creating ripple effects in the global display market that is dominated by Korean, Chinese and Japanese companies.

In November 2016, Sharp, now owned by Taiwan’s Hon Hai Group -- more widely knowns as Foxconn -- notified Samsung, the world's largest TV maker, that it would stop supplying liquid-crystal display panels from 2017.

The short notice came after Samsung increased orders from Sharp as it was reducing its own LCD production to focus more on organic light-emitting diode panels whose demands are soaring for mobile devices.

|

Related:

[SHARP SHOCK] Samsung launches US$500m legal battle against Sharp

[SHARP SHOCK] Crosstown rivals Samsung, LG seek rare partnership

Sharp has provided an annual 5 million LCD panels for Samsung, totaling about 10 percent of the Korean tech giant’s annual TV production, which stands at 50 million units. For this year, sources said, Samsung had increased orders to some 6 million units.

Sharp has not yet made any official comment on the decision.

Industry watchers say Foxconn, the largest iPhone manufacturer, is seeking to expand its presence in the appliance market overall. Especially, its billionaire Chairman Terry Gou has never bothered to hide his ambition to take on Samsung.

“Foxconn has been preparing to start its own TV and interactive-display business. Amid a global shortage of larger LCD panels, the company may have decided to halt supplies to rivals, including the biggest Samsung,” said an official of a local display maker on condition of anonymity.

Another source added Foxconn is also aiming to secure an upper hand in the next supply talks with Samsung and other TV makers.

“Considering that the new business plans will take years to be realized, there is no reason for Sharp to give up immediate profits from Samsung that make up almost half of its total sales,” the source said. “Sharp is likely to raise supply prices in the longer term.”

|

The first six months of a year are usually considered as off-season for TV panel sales. But conditions may not improve after that due to the recent struggle between Sharp and Samsung.

“Some buyers may choose to place orders in advance to avoid the risk of panel shortage in the busy season,” WitsView, a display unit of market research firm TrendForce, said in a recent report.

For the time being, Samsung has decided to increase supply from its affiliate Samsung Display, while asking help from its crosstown rival LG Display, Taiwan’s AUO and China’s BOE. Japan’s Sony, which receives panels from Samsung Display, is now in talks with LG Display and other Chinese display makers to fill the gap.

“Sharp is the sole supplier of 60-inch panels to Samsung. Samsung, along with other TV makers, will make all-out efforts to secure large-size panels to drive up prices in the first half of this year,” said Soh Hyun-cheol, an analyst at Shinhan Investment and Securities.

Currently, LG Display and Samsung Display own 19.6 percent and 18.6 percent shares in the global LCD market, respectively, while Sharp and Innolux -- both owned by Foxconn -- hold a combined 18.6 percent.

By Lee Ji-yoon (jylee@heraldcorp.com)

![[Contribution] Future-oriented partnership between Korea, Singapore](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=151&simg=/content/image/2024/10/24/20241024050632_0.jpg)

![[From the scene] How a Mercedes plant is turning dead EV batteries into fresh materials](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=151&simg=/content/image/2024/10/24/20241024050620_0.jpg)