Industrials

SK Hynix may join hands with Foxconn for Toshiba bid

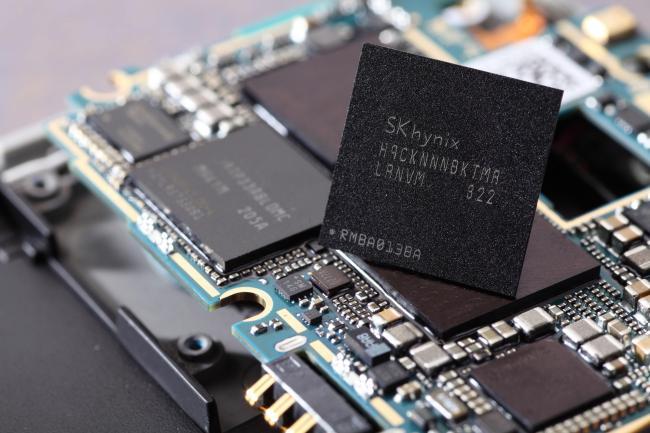

[THE INVESTOR] South Korea’s chipmaker SK Hynix may join hands with Taiwanese tech giant Foxconn to acquire a chip unit of Toshiba, industry watchers said.

Toshiba could sell 100 percent of its chip unit to offset the massive loss at its US nuclear power plant construction business -- instead of the initial plan of selling a 19.9 percent stake, according to Nikkei Asian Review. This may reap a profit of more than $8.7 billion from the sale.

|

This has made things trickier for SK Hynix, whose cash assets are far from enough to pay for the deal. The Korean chip maker reportedly holds around 4 trillion won ($3.4 billion) in cash assets.

Industry watchers predicted SK Hynix may join hands with Taiwanese company Foxconn, also known as Hon Hai Precision Industry, to acquire Toshiba’s chip business. Foxconn’s Chairman Terry Gou has been “very serious” about bidding for Toshiba’s memory chip business.

Foxconn, whose chairman has a close relationship with SK Chairman Chey Tae-won, is currently the fourth largest shareholder of SK Group with a 3.5 percent stake. The two firms have built a close relationship since 2014 when Foxconn bought some shares of SK. They jointly set up a tech firm FSK Holdings in Hong Kong in 2015, SKT’s Luna phone was produced at Foxconn’s factory and SK C&C won a contract for Foxconn’s smart factory in Chongqing.

“By joining hands with Foxconn, SK Hynix may lower the financial burden for acquiring Toshiba and also lower the possibility of disapproval from the Japanese government. Foxconn has proved an amicable relationship with the Japanese government through the latest acquisition of Sharp,” said Yoo Jong-woo, an analyst at Korea Investment & Securities.

“One variable might be who will get more shares from the acquisition but there is less possibility of conflicts of interest between the two firms,” Yoo added.

Having said so, there are also concerns that either joint or sole acquisition may not benefit SK Hynix.

“When Hynix acquires Toshiba with Foxconn, it will only benefit the Taiwanese firm, whose chip technology is five years behind SK Hynix. The acquisition may also become a winner’s curse as the boom in NAND flash market is likely to end within two years,” said an industry source, who declined to be identified.

SK Hynix declined to make any comment, saying it has no further stance except for the CEO’s earlier remarks on a possible review on the acquisition. Its CEO said in February that the company would review the deal when Toshiba proposes it.

Toshiba will hold an extraordinary shareholders meeting March 30 to officially spin off its semiconductor business effective April 1, according to Nikkei Asian Review. The Japanese company has set a one-month bidding period to allow interested parties to form coalitions. The interested parties have been noted to include Foxconn, Western Digital, Micron Technology and SK Hynix as well as various private equity entities.

By Shin Ji-hye/The Korea Herald (shinjh@heraldcorp.com)