Industrials

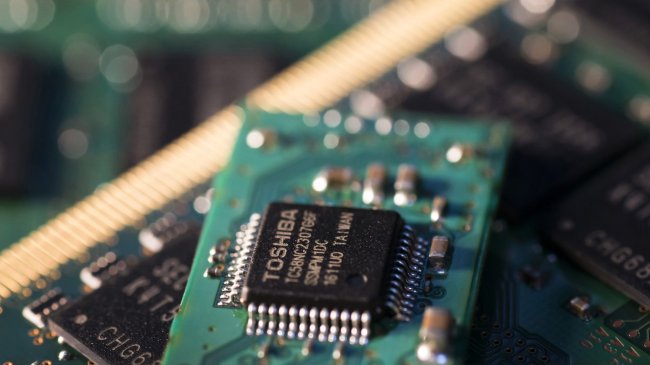

SK hynix joins hands with Japan’s ORIX for Toshiba deal: report

[THE INVESTOR] Japanese financial company ORIX has recently joined SK hynix to acquire Toshiba’s chip business possibly as part of the Korean chipmaker’s efforts to soothe negative sentiments in Japan, the Korea Economic Daily reported on June 2.

Citing unnamed industry sources, the report said, ORIX is joining the SK hynix-led consortium consisting of multinational investors such as US private equity firm Bain Capital.

|

Along with funding for the mega deal, ORIX is expected to play a role in mediating related talks with key players such as Japanese government-backed fund Innovation Network Corp. of Japan and US chipmaker Western Digital, Toshiba’s manufacturing partner that is opposing the planned sale.

“Non-pricing issues such as tech leak concerns will become deciding factors in the deal process,” a banking source was quoted saying. “ORIX is allegedly considering proposing that INCJ will become the largest shareholder at the new entity.”

The report said SK hynix has recently hired Credit Suisse as a financial advisor adding to the current Morgan Stanley, calling it a “rare move” that shows the company’s willingness to win the Toshiba deal.

As of May 19, the deadline for second-round offers, the SK hynix consortium reportedly offered slightly over 1 trillion yen (US$8 billion), which compared to Broadcom’s about 2.2 trillion yen.

By Lee Ji-yoon (jylee@heraldcorp.com)