Economy

Growth outlook contradicts business sentiment

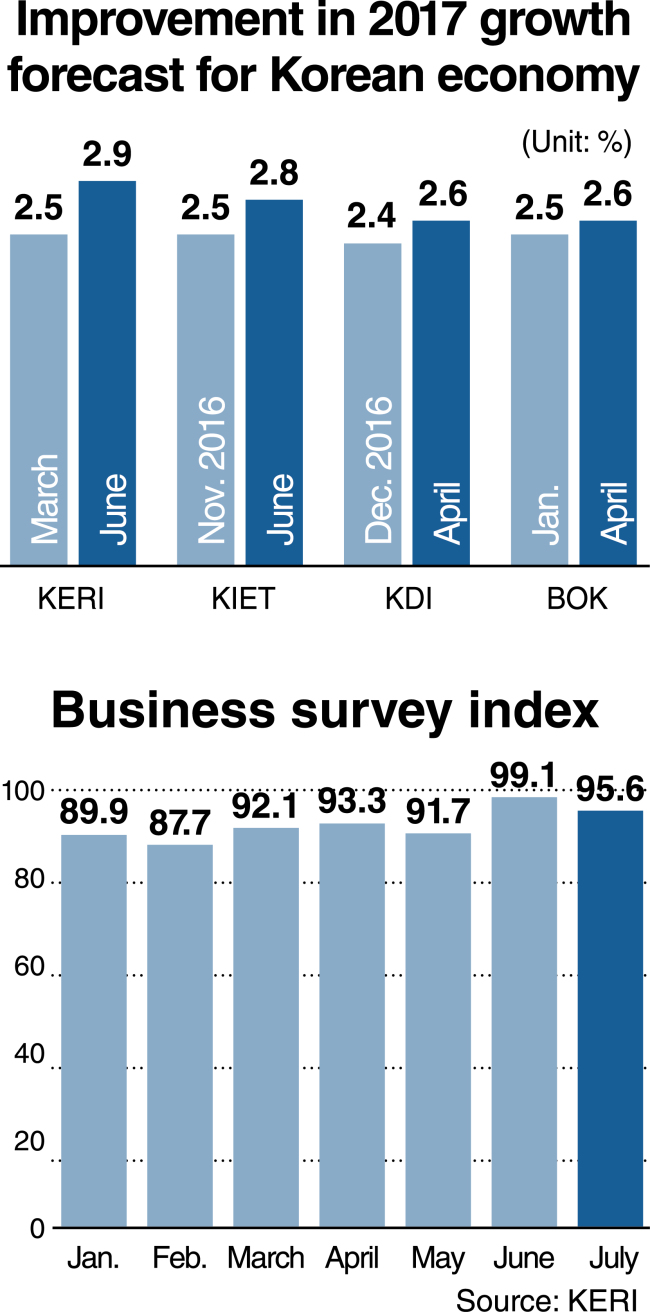

[THE INVESTOR] Local economic research institutes have recently revised up their 2017 growth forecasts for the Korean economy.

Such upward revisions, partly based on a rebound in exports, are out of sync with the nation’s business sentiment, which remains low.

|

Economists say the country’s economy may still be held back by rising household debt, sluggish domestic consumption, a possible fall in property prices and uncertain external conditions.

In this regard, attention is being drawn to plans to be unveiled by the government this month for running the economy in the second half of this year.

Policymakers seem to hope the implementation of an 11.2 trillion won ($9.8 billion) supplementary budget, coupled with other measures aimed at boosting the economy, would help push up this year’s growth rate set by the government at 2.6 percent.

But objections from opposition parties make it uncertain that the extra budget bill, designed mainly to help create more jobs and shore up the livelihoods of low-income households, will get parliamentary approval.

The Korean economy expanded 2.8 percent in 2015 and 2016, down from 3.3 percent in 2014.

Korean think tanks initially forecast Asia’s fourth-largest economy would fall short of reaching the government-set growth target this year.

In recent months, however, they have revised up their growth outlooks for the economy, citing a continuous upturn in exports on the back of recovering global demand.

Korea’s outbound shipments grew for the eighth consecutive month in June, reaching $51.4 billion, up 13.7 percent from a year earlier, according to data released by the Ministry of Trade, Industry and Energy on July 1.

In the first quarter of 2017, the country’s gross domestic product rose 1.1 percent, marking the highest since the third quarter of 2015, according to the Bank of Korea.

The central bank, which in April revised up its growth forecast for this year to 2.6 percent from an earlier estimate of 2.5 percent, is expected to make a further upward adjustment later this month.

The Korea Economic Research Institute, a private think tank, last week upgraded its 2017 growth outlook for the Korean economy to 2.9 percent from an earlier prediction of 2.5 percent.

The research institute attributed the upward revision to increased exports amid a recovery in the world economy and more corporate capital spending.

Earlier last week, the Korea Institute for Industrial Economics and Trade, a state-run think tank, also revised up its 2017 growth forecast for the country’s economy by 0.3 percentage point to 2.8 percent, citing rising global trade and what it saw as eased uncertainties at home and abroad.

In the coming months, other local economic institutes and global investment banks are expected to make an upward revision of their estimates of the Korean economy’s expansion this year.

Contradicting the improved growth prospects are the negative business sentiment and other sluggish economic indicators.

The business survey index for July, based on a recent KERI poll of 600 local companies, stood at 95.6, hovering below 100 for 14 consecutive months. The figure went down to 92.2 for the manufacturing sector.

A reading below 100 means there are more firms that expect business conditions will worsen, while a reading above the benchmark points to positive sentiment prevailing.

Cho Joon-mo, an economics professor at Sungkyunkwan University in Seoul, said the contradiction between growth outlook and business sentiment “shows the discrepancy between exports and domestic economic conditions.”

The strong rebound in the country’s exports is led mainly by a steep rise in outbound shipments of certain items such as semiconductors, steel and petrochemical products.

But a larger number of companies in other sectors are struggling to find overseas markets for their goods and cope with slumping domestic consumption.

According to figures released by Statistics Korea on June 30, retail sales in the country decreased 0.9 percent from a month earlier in May, with total industrial output also declining 0.3 percent.

While revising up its growth outlook last week, the KERI predicted that private consumption would grow 1.9 percent on-year in 2017, down from a 2.5 percent increase last year, due to the country’s aging population and mounting household debt that carries heightening interest rates.

Construction investment was forecast to lose steam in the second half -- growing 5.3 percent on-year for the whole year of 2017, down from a 10.7 percent surge last year -- as the government strengthens measures to curb household debt and cool down the property market that shows signs of bubbling in some areas.

Economists here also note Korea’s exports will likely face downside risks for the rest of the year, including additional US rate hikes, trade protectionism pursued by Donald Trump’s administration, anti-globalization trends in some European countries and a fall in global oil prices.

Taking note of these challenges facing the Korean economy, the Organization for Economic Cooperation and Development has pegged its 2017 growth forecast for the country at 2.6 percent since November while revising up its global growth outlook for the year to 3.5 percent from 3.3 percent.

Finance Minister Kim Dong-yeon, who doubles as deputy prime minister for economic affairs, said last week the government has no immediate plan to raise its growth projection of 2.6 percent despite an upturn in exports.

“We have to be careful (about adjusting up the growth forecast),” said Kim, citing external conditions that could turn worse.

Economists note President Moon Jae-in’s administration needs to manage downside risks, implement aggressive stimulus measures and accelerate deregulation in order to pull the economy out of its low-growth rut.

Despite the recent improvement in Korea’s economic outlook, think tanks at home and abroad have fallen short of pushing up their growth forecasts for the country above the 3 percent perceived as a target for achieving its growth potential.

“An active push for deregulation and corporate restructuring is needed to boost the country’s growth potential,” said Jung Kyu-chul, a researcher at the Korea Development Institute, a state-run think tank.

By Kim Kyung-ho/The Korea Herald (khkim@heraldcorp.com)