Industrials

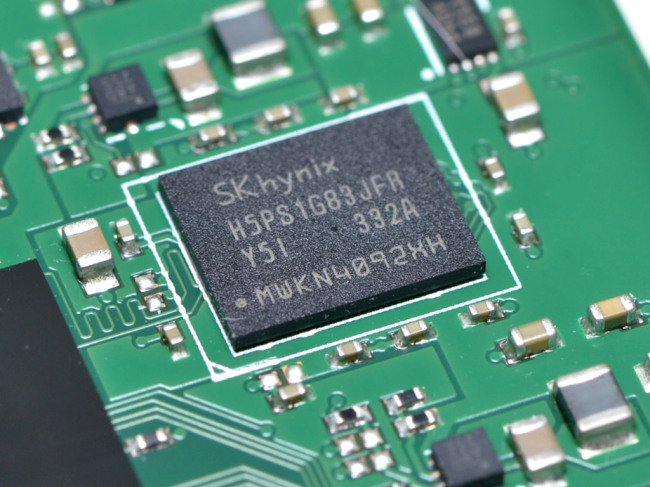

SK hynix seeks up to 15% stake in Toshiba's chip unit

[THE INVESTOR] SK hynix said on Sept. 27 it has decided to invest 4 trillion won (US$3.50 billion) for the purchase of Toshiba’s NAND business unit worth 20 trillion won by a Korea-US-Japan consortium.

The investment includes its rights to acquire a sizeable stake in the new spun-off entity but the purcase cannot exceed 15 percent for the next 10 years.

The world’s second-largest DRAM chipmaker said the upcoming stake ownership would help it strengthen its competitiveness in the NAND chip market in the long term. Currently, Toshiba is the second-largest NAND maker, while SK hynix is the fifth.

SK Chairman Chey Tae-won left for a business trip to the US and Japan right after the investment plan was approved by the board on the day.

|

The Korea-US consortium led by SK hynix and Bain Capital will acquire a total 49.9 percent stake, with Toshiba maintaining a 40.2 percent stake. The remaining stake will be held by Japan’s Hoya.

SK hynix said it is investing 1.3 trillion won of the total funding as convertible bonds that can be used for the stake purchase. The remaining 2.7 trillion won will be invested in a new fund that will be set up by Bain Capital for investment earnings.

Toshiba plans to close the deal by March next year.

By Lee Ji-yoon (jylee@heraldcorp.com)