Finance

Is the heyday already over for Kakao Bank?

[THE INVESTOR] Korean internet-only banks, which were secretly feared like the plague by conventional banks, appear to be waning.

In just a year since their inception, Kakao Bank and K-bank are seeing a drastic decline in their key indices such as deposits, loans and membership volume.

|

Related:

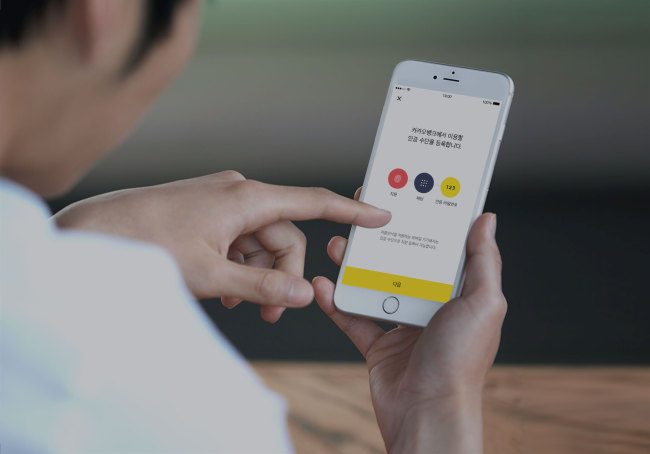

Catch me if you can: Kakao Bank

The number of clients at K-bank, which was the first internet-only bank in Korea, and Kakao Bank amounted to 6.58 million as of the end-April. During that month, membership rose just 3.1 percent.

Up until October last year, membership at the two banks had grown by double-digits, but it fell to a single-digit figure in November. Beginning in March this year, it has stayed at 3 percent.

“The growth appears to be slowing, even for Kakao Bank, which had seen some success due to its name, which Koreans are more than familiar with due to KakaoTalk,” said one industry watcher, declining to be identified.

The two banks had deposits of 8.94 trillion won (US$8.27 billion) as of end-April, up 6.1 percent from the previous month. Loans grew 5.2 percent to 7.25 trillion won. In comparison, loans at four brick-and-mortar banks Kookmin, Shinhan, KEB Hana and Woori grew 6.2 percent last month.

Combined, the deposits at K-bank and Kakao Bank amounted to 0.49 percent of the total figure at conventional banks. Loans took up 0.45 percent.

Industry watchers attribute the sluggish growth to a number of factors.

One is that clientele is limited to younger folks. Second, it’s hard to sell products without any direct interaction with customers. Third, the bigwigs –- corporates -- are reticent to use internet bank services. Fourth, the banks don’t have access to mortgage loans, which take up 70 percent of all household loans in Korea.

Last but not least, the limits on raising capital pose a problem. Under current laws, it’s impossible for the stakeholders of these two banks -- in particular K-bank which has mostly non-banking sector shareholders who have limited access to investing in the banking industry -- to raise more capital, based on which they can extend more loans.

By Bryan Hong (bhong@heraldcorp.com)