Deals

Roundtable nudges Korean firms into cross-border M&As to fight trade spat with Japan

A roundtable comprising business associations, trade agencies and financial institutions in South Korea on Sept. 25 recommended a potential list of foreign companies whose shares are potentially up for sale.

The event, held at the headquarters of Korea Financial Investment Association, was aimed at encouraging more domestic companies to seek a breakthrough following the souring bilateral relationship with Japan and keep their supply chain unscathed with cross-border mergers and acquisitions.

|

A total of 82 foreign companies -- either owned by private equity firms, are engaged in a court receivership or considering stake sales -- were showcased by Andrew Kim, manager of outbound investment & M&A team at the Korea Trade-Investment Promotion Agency (Kotra).

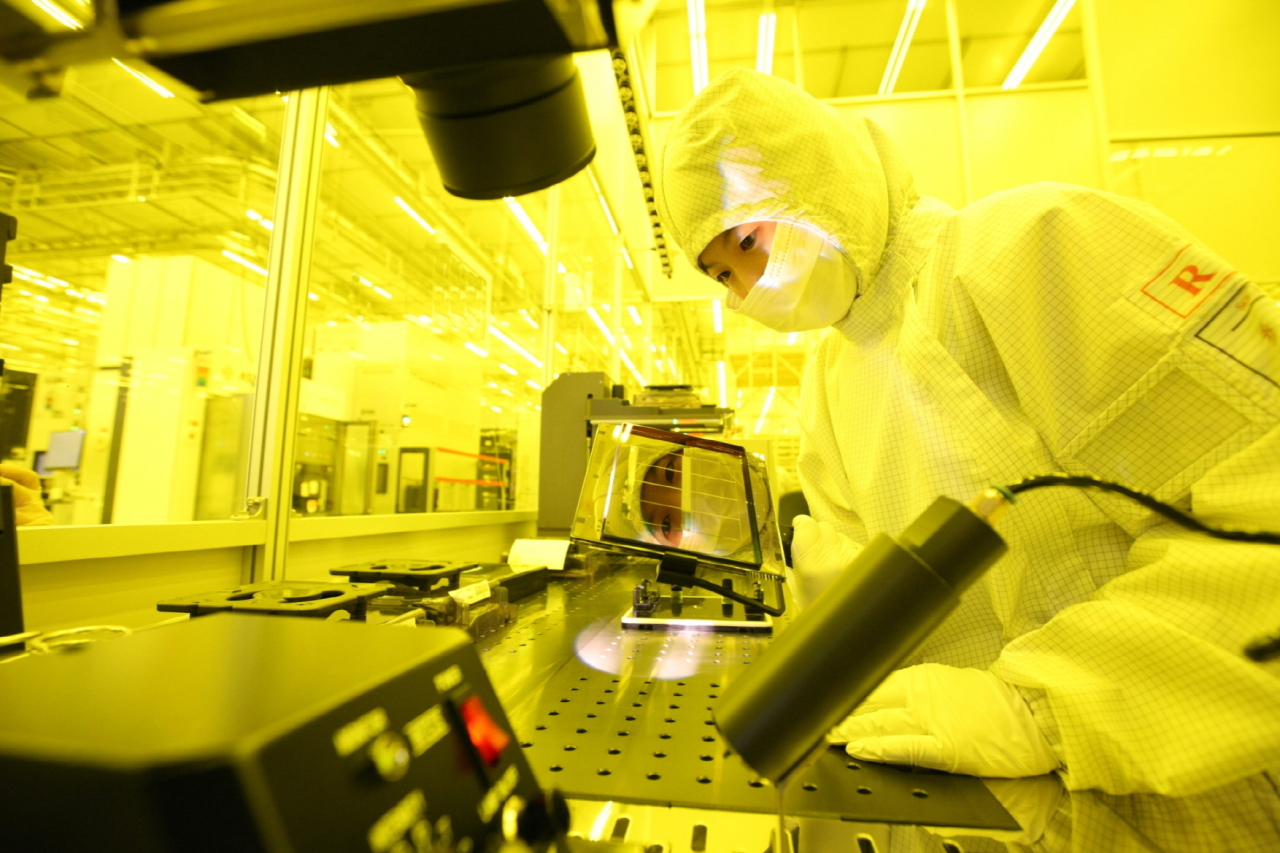

A majority of these companies are dedicated to manufacturing chemical materials, transistors, parts for semiconductors and vehicles, electronic components, industrial automation solutions, consumer goods like ceramic wares, kids’ clothing, toys, as well as baked goods.

By countries, there were 31 German companies, 16 US companies and 12 Vietnamese firms. Others came from European countries like Belgium, Spain, Austria, France, Poland and Italy; Asian countries like Japan and Indonesia.

“The role of the roundtable is to identify targets for M&As for potential buyers,” said Ko Dae-young, team head of syndicated & leveraged finance at Korea Development Bank.

“It is energy-consuming for an individual company to locate which companies are potentially up for sale.”

Ko referred to the roundtable comprising 14 entities, formed on Sept. 10.

Identifying the potential buyers are organizations representing business circles like the Korea Chamber of Commerce and Industry, as well as associations of respective industries such as semiconductors, automotive, machinery, display panels and oil refineries.

Once a Korean buyer finds a right match with the support of agencies like Kotra, financial institutions such as KDB, Industrial Bank of Korea, Export-Import Bank of Korea and NongHyup Bank, will offer a financial leverage to the M&A activities.

This comes as trade tensions between Korea and Japan have heightened, affected industries of both countries. Both nations have excluded each other from their trade whitelist.

By Son Ji-hyoung (consnow@heraldcorp.com)