Bio

Samsung Bioepis seeks to take on Celltrion with speedy clinical trials

[THE INVESOTR] Samsung Bioepis, a biosimilar making arm of Samsung Group, is attempting to overtake its bigger rival Celltrion with a richer drug pipeline formed by shortening the duration of clinical trials despite reporting consecutive annual losses, analysts said on July 4.

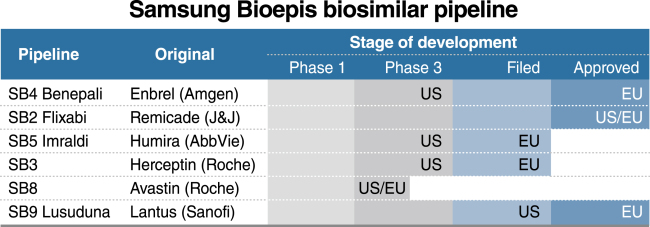

Samsung Bioepis, a runner-up in the biosimilar market founded in 2012, has a total of six drug candidates in a more advance stage than Celltrion, including three approved by Europe’s pharma regulator -- Benepali, Renflexis and Lusuduna.

Two more proposed biosimilars referencing Herceptin and Humira are currently being reviewed by the European authorities.

|

The 15-year old firm Celltrion, which started to develop biosimilars years earlier than Bioepis, released two products and will add its version of Herceptin into the mix while five other drug candidates haven’t yet entered the early clinical stage.

“Samsung Bioeips has quickly consolidated its market presence in the biosimilar industry despite high entry barriers and the key is the short clinical time,” said Kevin Jin, analyst at Korea Investment & Securities.

While it typically takes a maximum of two years for biosimilars to gain marketing approval, Samsung Bioepis has shortened the period to one year.

To reduce the reliance on contract research organizations, Samsung Bioepis sent its own administrative staff to whichever country and closely cooperated with partner companies to shorten the time needed to win approval.

“In that sense, we believe Samsung Group’s ability to rapidly respond to the market, which has been demonstrated in the display, semiconductor and smartphone industries, will prove very useful with biosimilars as well,” Jin said.

For biosimilar makers, releasing its products ahead of rivals is a decisive factor because their near-replicas of biologic drugs are designed to have a similar therapeutic efficacy and safety with reference treatment which means the success of copy versions is hard to be determined by quality.

|

There is a lot of overlap between the two companies’ drug portfolios, commercialized or under development, including biosimilar versions of the world’s top selling branded therapies -- Enbrel, Remicade, Herceptin, Humira, Avastin and Rixutan.

Though, Samsung Bioepis has a long way to go to stand shoulder-to-shoulder with Celltrion, in terms of revenue.

Samsung Bioepis posted its fifth consecutive yearly net loss of 106.47 billion won in 2016 while Celltrion reported a net profit of 180.5 billion won.

“Celltrion is leveraging its first-mover advantage by rolling out copycat therapies before any other companies,” Han Byung-hwa, analyst at Eugene Investment & Securities.

Celltrion’s Remsima, the first biosimilar of Johnson & Johnson’s Remicade gained EU approval back in 2013 and launched in 2015, is expected to capture 50 percent of the EU market, which in turn accounts for around a third of global sales, by end of 2017.

Truxima, the company’s version of Roch’s Rituxan is also projected to penetrate easily into the EU and US markets as the world‘s first biosimilar with an oncology indication, Han said.

The company is awaiting EU approval on its Herceptin biosimilar Herzuma while conducting the final phase 3 clinical trial for the under the skin injection formation of Remsima for 2019 launch.

“With the biosimilar trio and subcutaneous version of Remsima, Celltrion’s sales which is previously forecasted to reach its peak in 2020 is likely to expand its growth momentum for three to five years,” Han added.

Meanwhile, Samsung Bioepis is likely to stay in the red until its products show substantial growth in the US and European markets.

In 2016, Samsung Bioepis launched two biosimilars in the European market -- Benepali, its version of Amgen’s anti-inflammatory Enbrel and Flixabi, copy of Remicade. Jin projected Benepali will have a market share of 21 percent in Europe, and Flixabi will attain 15 percent in the US by 2021.

Two more biosimilar candidates developed by Samsung Bioepis -- Imraldi, version of Abbvie’s arthritis drugs Humira and Lusuduna, version of Sanofi’s insulin drug Lantus -- are gearing up for global market debut.

By Park Han-na (hnpark@heraldcorp.com)

![[KH Explains] Korean shipbuilding stocks rally: Real growth or bubble?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=151&simg=/content/image/2024/04/25/20240425050656_0.jpg)

![[Hello India] Hyundai Motor vows to boost 'clean mobility' in India](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=151&simg=/content/image/2024/04/25/20240425050672_0.jpg)